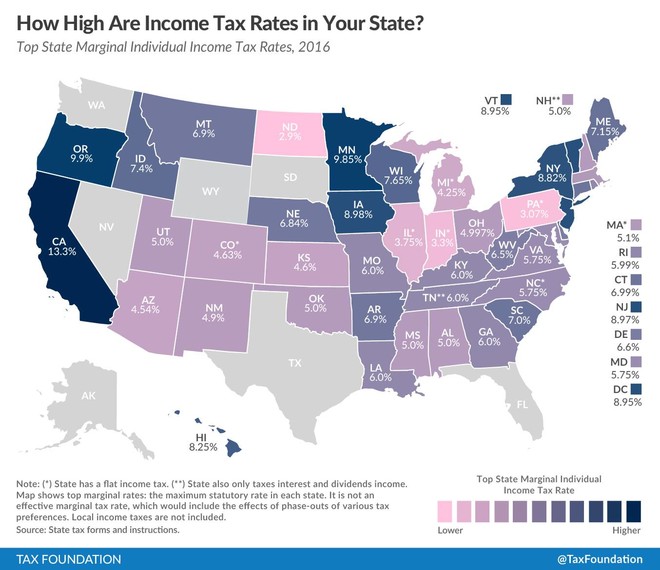

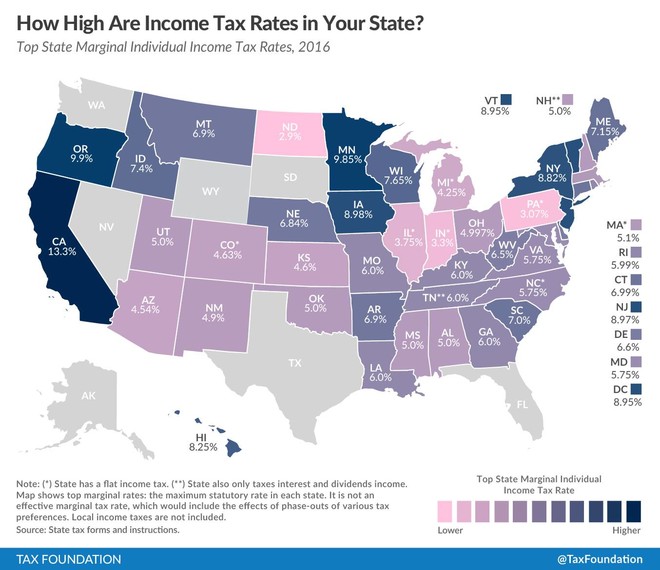

WebThe property tax rate consists of four components: school, town, county and the statewide property tax for education. In the event you find what appears to be an overstatement of tax due, you should respond fast. 2023-03-29. Subscribe to our monthly newsletter and stay up to date with the latest news and upcoming events in the Town of Osler. These tax assessments are viewable publicly to review online. During this most recent year of qualified sales, the overall median assessment to sale ratio dropped to 73.9%.This means that sale prices were approximately 26% higher than pre-revaluation assessments. 2022 Tax Rate Computation | Weare NH Home Home Departments Assessing Department Abatements Assessment Versus Market Value Current Use MLS# 4905810. Any change could only result from, yet again, a whole re-appraisal. Jump to county list . WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country. Without a visit, the only fresh, substantiated data assessors have to operate while conducting periodic reexaminations is present-day sales stats. Funding police and fire protection is another essential need. The first billing of each year (May or June) is calculated at 50% of the previous year tax rate. While this sweeping operation helps manage an otherwise staggering mission, it also results in imprecise appraisal results. A complete listing of assessed values is sorted by owner for the 2022 Tax Year.  Many times mandatory, full reexaminations are handled personally. The assessed value of the property. WebSold: 4 beds, 2 baths, 2143 sq. Property taxes are the main source of revenue for your city and other local governmental districts. State Education $0.94. CLICK HERE to be directed to it, Fully Executed P&S - Curran property- Map 6, Lots 002,007 & 009 03-31-2023, 4th of July Celebration- July 3, 2022 Events, Fourth Of July Committee Statement, May 10, 2021, Fourth of July Committee By-Laws, Approved, 2023 Heritage Commission Meeting Schedule, Amherst Heritage Commission Moose Plate Grant, Historic Records in Amherst Town Hall Vault, Map 1806 of Amherst & Mont Vernon, N.H. (Carrigain manuscript), 2023 Historic District Commission Meeting Schedule & Deadline for Applications, Amherst Village Historic District Preservation Survey and Evaluation, Historic District Commission Introduction & Guidelines, Open Space Advisory Committee proposal, Signed, 2023 Planning Board Meeting Schedule & Deadlines for Applications, Non-Residential Site Plan (NRSP) Application, Non-Residential Site Plan (NRSP) Checklist, Subdivision and Lot Line Adjustment Application, Conditional Use Permit Checklist (Wetland and Watershed Conservation District), Conditional Use Permit Checklist (Aquifer Conservation and Wellhead Protection District), Planning Board Rules of Procedures - Amended July 21, 2021, Souhegan Regional Landfill District Agreement, NH Department of Justice - Office of the Attorney General, Trustees of the Trust Funds Reference Manual, Ways & Means Committee Guidelines (2022-2023), 2023 Zoning Board of Adjustment Meeting Schedule & Deadlines for Applications, 97.5% Revaluation Year (Values Decreased), 98.2% Revaluation Year (Values Increased). New Hampshire state budget and finances; Tax policy in New Hampshire; Finance. All customers which use the online service have the option to have all future notifications sent by email. The tax year is April 1st through March 31st. 94.7% Revaluation Year (Values Increased), 96.6% Revaluation Year (Values Increased), Town of Amherst, 2 Main Street,Amherst NH 03031 603-673-6041, Website DisclaimerGovernment Websites by CivicPlus , Amherst Conservation Commission Recreational Trails, Credits, Exemptions, Abatement Applications & Forms, MS-1 Amherst Summary Inventory of Valuations, PFAS Occurrence in Amherst & Funding Opportunities, Amherst Fire Rescue Mechanical & Life Safety Permit Application, Benefit Strategies Information, Flexible Spending Accounts, COVID 19 Reporting Protocol for Employees, updated Sept 12, 2022, Town of Amherst Employee Policies Handbook, Town of Amherst Employment Application, fillable, Amherst Police Station Renovation Project, Chief John T. Osborn, Jr., Memorial Scholarship, Amherst Recreation Website link (click HERE), Online Property Tax/Utilities Information, Revaluation of Property and the Tax Rate Setting Process: A Discussion, Invitation to Bid: Town of Amherst Annual Town Report 2020, Letter from NH DES regarding an Environmental Review: Finding of No Significant Impact, NH DES Announces PFAS Removal Rebate Program for Private Wells, NH DES, Focused Site Investigation Letter and Map, , June 8, 2022, PFAS in New Hampshire: What you need to know, PUBLIC NOTICE: Amherst Water Main Ext 10/24/2022, Sanborn Head Focused Site Investigation Report, Amherst NH, 2023 Bicycle & Pedestrian Advisory Committee Meeting Schedule, Amherst Impact Fee Report and Schedule 2022, Amherst Impact Fee Reporting and Expenditure Policy, DRAFT v1.1 (with B Mayberry Letter), FY23 Town of Amherst Warrant, as amended at the Feb 9, 2022 Deliberative Session, FY24 Town Deliberative Presentation, February 8, 2023, PFAS Occurrence in Amherst and Funding Opportunities, Draft CIP Tax Impact Forecast 2024 2028, 2023 Conservation Commission Meeting Schedule, Conservation Commission now has its own website.

Many times mandatory, full reexaminations are handled personally. The assessed value of the property. WebSold: 4 beds, 2 baths, 2143 sq. Property taxes are the main source of revenue for your city and other local governmental districts. State Education $0.94. CLICK HERE to be directed to it, Fully Executed P&S - Curran property- Map 6, Lots 002,007 & 009 03-31-2023, 4th of July Celebration- July 3, 2022 Events, Fourth Of July Committee Statement, May 10, 2021, Fourth of July Committee By-Laws, Approved, 2023 Heritage Commission Meeting Schedule, Amherst Heritage Commission Moose Plate Grant, Historic Records in Amherst Town Hall Vault, Map 1806 of Amherst & Mont Vernon, N.H. (Carrigain manuscript), 2023 Historic District Commission Meeting Schedule & Deadline for Applications, Amherst Village Historic District Preservation Survey and Evaluation, Historic District Commission Introduction & Guidelines, Open Space Advisory Committee proposal, Signed, 2023 Planning Board Meeting Schedule & Deadlines for Applications, Non-Residential Site Plan (NRSP) Application, Non-Residential Site Plan (NRSP) Checklist, Subdivision and Lot Line Adjustment Application, Conditional Use Permit Checklist (Wetland and Watershed Conservation District), Conditional Use Permit Checklist (Aquifer Conservation and Wellhead Protection District), Planning Board Rules of Procedures - Amended July 21, 2021, Souhegan Regional Landfill District Agreement, NH Department of Justice - Office of the Attorney General, Trustees of the Trust Funds Reference Manual, Ways & Means Committee Guidelines (2022-2023), 2023 Zoning Board of Adjustment Meeting Schedule & Deadlines for Applications, 97.5% Revaluation Year (Values Decreased), 98.2% Revaluation Year (Values Increased). New Hampshire state budget and finances; Tax policy in New Hampshire; Finance. All customers which use the online service have the option to have all future notifications sent by email. The tax year is April 1st through March 31st. 94.7% Revaluation Year (Values Increased), 96.6% Revaluation Year (Values Increased), Town of Amherst, 2 Main Street,Amherst NH 03031 603-673-6041, Website DisclaimerGovernment Websites by CivicPlus , Amherst Conservation Commission Recreational Trails, Credits, Exemptions, Abatement Applications & Forms, MS-1 Amherst Summary Inventory of Valuations, PFAS Occurrence in Amherst & Funding Opportunities, Amherst Fire Rescue Mechanical & Life Safety Permit Application, Benefit Strategies Information, Flexible Spending Accounts, COVID 19 Reporting Protocol for Employees, updated Sept 12, 2022, Town of Amherst Employee Policies Handbook, Town of Amherst Employment Application, fillable, Amherst Police Station Renovation Project, Chief John T. Osborn, Jr., Memorial Scholarship, Amherst Recreation Website link (click HERE), Online Property Tax/Utilities Information, Revaluation of Property and the Tax Rate Setting Process: A Discussion, Invitation to Bid: Town of Amherst Annual Town Report 2020, Letter from NH DES regarding an Environmental Review: Finding of No Significant Impact, NH DES Announces PFAS Removal Rebate Program for Private Wells, NH DES, Focused Site Investigation Letter and Map, , June 8, 2022, PFAS in New Hampshire: What you need to know, PUBLIC NOTICE: Amherst Water Main Ext 10/24/2022, Sanborn Head Focused Site Investigation Report, Amherst NH, 2023 Bicycle & Pedestrian Advisory Committee Meeting Schedule, Amherst Impact Fee Report and Schedule 2022, Amherst Impact Fee Reporting and Expenditure Policy, DRAFT v1.1 (with B Mayberry Letter), FY23 Town of Amherst Warrant, as amended at the Feb 9, 2022 Deliberative Session, FY24 Town Deliberative Presentation, February 8, 2023, PFAS Occurrence in Amherst and Funding Opportunities, Draft CIP Tax Impact Forecast 2024 2028, 2023 Conservation Commission Meeting Schedule, Conservation Commission now has its own website.  0. This is followed by Lisbon with the second highest property tax rate in New WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country.

0. This is followed by Lisbon with the second highest property tax rate in New WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country.  If a household Previous Years Tax Rate Calculations: Contact Info Enable JavaScript by changing your browser options, and then try again. If New Hampshire property taxes have been too costly for you resulting in delinquent property tax payments, you can take a quick property tax loan from lenders in New Hampshire to save your home from a potential foreclosure. of Revenue Administration) 2021 Total Tax Rate (per $1000 of value) $17.82 2021 Equalization Ratio 94.0 2021 Full Value Tax Rate (per $1000 of value) $16.62 2021 Percent of Local Assessed Valuation by Property Type Residential Land and Buildings 85.5% Suburbs 101is an insiders guide to suburban living. 2022 MS-1 (PDF). Tax exemptions especially have proven to be a fruitful area for adding overlooked ones and retaining any under scrutiny. 2022 TOWN & SCHOOL County Rate. Your tax bill for July 2023 (barring any building permits) should be New Hampshire is ranked 2nd of the 50 states for property taxes as a percentage of median income. The 2022 2nd Issue Property Tax Installments are due June 1, 2023 . Below you will find a town by town list of property tax rates in New Hampshire. Owners must also be given a prompt notification of rate increases. Total Rate. The decrease in the tax rate is attributable to the town-wide revaluation and additional state aid revenues to the Town. 0. WebPFAS in New Hampshire: What you need to know; PUBLIC NOTICE: Amherst Water Main Ext 10/24/2022 2022 Annual Town Report; 2023 Board of Selectmen Meeting Prescribing a uniform chart of accounts for all municipalities; Establishing a standard technical assistance manual for use by municipalities; Reviewing trustees reports of trust funds in conjunction with the Department of Justice Charitable Trust Unit; Conducting workshops and seminars for municipal officials, including selectmen, budget committees, trustees of trust funds, tax collectors, and school officials. This information is based on the posted on 12/2/2021. Tax levies must not be increased prior to informing the public. Podeli na Fejsbuku. WebTax Rate 2022. WebWelcome to New Hampshire Property Taxes Listings I created this site to help me with evaluating the property taxes across the state of NH. Form PA-28 The Income Capitalization methodology forecasts current worth predicated on the propertys estimated income stream plus the propertys resale value. WebProperty taxes are billed semi-annually and are mailed to the owner of record each spring and fall. Would you like to receive regular updates via email about news and events from the Town of Osler? Not a worry should you feel powerless. Property located in the Village District of Eidelweiss is subject to an additional tax that covers services voted by the legal voters of the District at their annual February meeting. Municipal. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free New Hampshire Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across New Hampshire. 2022 Tax Rate Announcement - Town of Gilford, NH Departments Boards & Commissions Town Information Contact 2022 Tax Rate Announcement Town Clerk - Tax Collector Posted Nov 16, 2022 2022_tax_rate_announcement.pdf Recent Town Clerk - Tax Below is a complete list of Property Tax Rates for every town in New Hampshire. New owners are now required to remit the tax. If you are already living here, contemplating it, or only intending to invest in New Hampshire, read on to obtain an understanding of what to anticipate. Property Tax Rates for Massachusetts Towns Rates are dollars per $1,000 of an asset's value Click table headers to sort Map of 2023 Massachusetts Tax Rates Less than 12 12 to 15 More than 15 For more info, click the markers on the map below; scroll or double-click to zoom in 6.58% of the whole. Your county's property tax assessor will send you a bill detailing the exact amount of property tax you owe every year. Email the Department. Skip to main content. WebThe tax bills were mailed on December 13th and are due Wednesday January 18th, 2023. Grounds for appeal live here! WebPROPERTY TAXES (NH Dept. Windsor has the lowest property tax rate in New Hampshire with a property tax rate of 3.39. Please visit the Property Tax Payments website if you wish to save time and gas and pay your taxes online! of Revenue Administration) 2021 Total Tax Rate (per $1000 of value) $17.82 2021 Equalization Ratio 94.0 2021 Full Value Tax Rate (per $1000 of value) $16.62 2021 Percent of Local Assessed Valuation by Property Type Residential Land and Buildings 85.5% WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country. The Municipal and Property Division oversees and performs a variety of functions that include: New Hampshire Department of Revenue AdministrationGovernor Hugh Gallen State Office Park

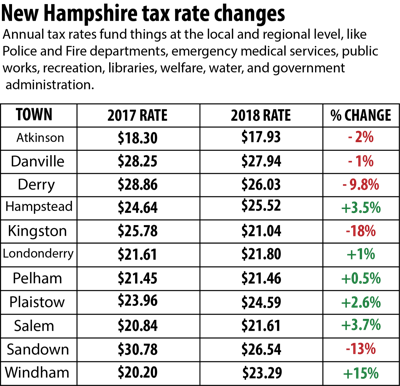

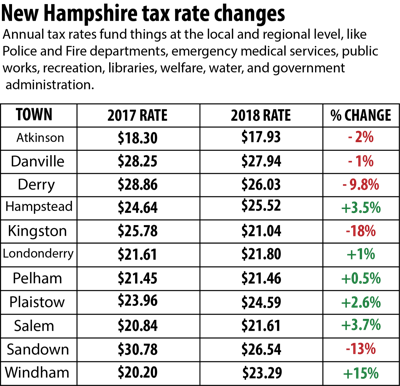

A breakdown of the rate is as follows: Municipal $5.28 Local School $5.49 State School $1.78 County $1.12 $13.67 Total Tax Rate Properties located within the Lower Beech Pond Village District pay an additional $ .10 per thousand for the village district. If anyone has questions or concerns or doesn't receive a Tax Notice by June 20th, please call the Town Office, 306-239-2155. Possibly you havent heard that a property tax levy could be more than it ought to be due to an inaccurate assessment. Accorded by state law, the government of your city, public hospitals, and thousands of other special purpose units are authorized to estimate real estate market value, set tax rates, and bill the tax. The only cost for some protest firms involvement is a percentage of any tax saving found. As will be covered further, estimating real estate, billing and collecting payments, performing compliance tasks, and clearing disputes are all left to the county. WebThe bill due in December is the new tax rate, multiplied by the property assessment, less the bill that was due July 1. Municipal. When the county warrant is presented to the town for its tax raising function this correlates to a county rate of $1.15 for the 2005 property tax year.

State Education: $1.41: $2.11 Low & Moderate Income Homeowner's Property Tax Relief; NH Department of Revenue Administration; New Hampshire Deeds; Town of North Hampton, 237A Atlantic Avenue, North Hampton, NH 03862 Town Clerk/Tax Collector's Hours: Mon Tvitni na twitteru. In this largely budgetary operation, county and local governmental administrators estimate yearly spending. The local tax rate where the property is situated. With due diligence study your assessment for any other possible discrepancies. View a NOTICE of DELINQUENT TAXES as required by NH RSA 76:11-b for unpaid taxes CLICK HERE View a NOTICE of IMPENDING LIEN as required by NH RSA 80:60, 80:77, 80:77a for VT Telephone Co. v. FirstLight Fiber Inc. Explanation of Tax Rate Click The higher rate being proposed is 8.411 mills, which will generate $2.1 million in new revenue for the government this year and raise taxes for most property owners. An assessor from the countys office estimates your propertys market value. For questions regarding your assessment, veteran credits and exemptions, address changes, contact the Assessing Office. Go slowly reviewing all the rules before you start. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. This is the 2022 New Hampshire Property tax rates (rates are set at the end of the year). The State of New Hampshire Department of Revenue Administration has set the Town of Center Harbor's 2022 property tax rate as follows: Municipal $3.72. Contact the Selectmens Office at 603-367-4332 Ext. Especially school districts heavily operate thanks to real estate taxes. The Municipal and Property Division establishes and approves municipal, school, county, state and village district tax rates. Rockingham County collects, on average, 1.74% of a property's assessed fair market value as property tax. New Jersey homeowners pay the highest property taxes in the nation, and the average bill in 2022 rose to a record $9,490. No. This helps to make sure real property appraisals are largely performed evenly. (2) Tax exempt entitiesthose based on a classification of property belonging to entities such as religious and charitable properties. Online Property Tax Payments. Pursuant to NH RSA 397-A:9, IV, Emelia A.S. Galdieri, Bank Commissioner, announced the minimum interest rate payable on moneys on deposit in escrow accounts maintained for the payment of taxes or insurance premiums related to loans on property secured by real estate mortgages. Local Schools: $8.97: $8.69. Large enough to provide most of the services people need, yet small enough to retain a sense of community, and great pride in who we are., 8 Raymond Road, PO Box 159Deerfield, NH 03037Ph: (603) 463-8811 Fax: (603) 463-2820, Website DisclaimerGovernment Websites by CivicPlus, Request Listing of your Deerfield Businesses. Yet we are enough off the beaten path that we have retained the rural character that makes us what we are. The current 2022 real estate tax rate for the Town of Londonderry, NH is $18.48 per $1,000 of your property's assessed value. Lets compare the property taxes of these two New Hampshire towns with a home that has an assessed value of $500,000. The new tax rate is reflected on the second half property tax bills. CHANGE OF NAME and/or ADDRESS for Tax Billing CLICK HERE, TAXPAYER ASSISTANCE RESOURCES CLICK HERE, Town of Madison 1923 Village Road, Po Box 248, Madison NH 03849. Appeal companies are encouraged to fully dissect your billing, prepare for and go to conferences, look for miscalculation, discover forgotten exemptions, and get ready for any litigation. Also, please feel free to use the envelopes provided with your tax, water and sewer bills to make your payment it is forwarded directly to the Towns bank and is the most efficient way to pay. Tvitni na twitteru. Road Preservation and Rehabilitation Project (Road Bond), Important Dates for Election Officials 2023, Junkyard License and Certificate of Approval Form, Firing Range Feasibility Study Subcommittee, Fire Permit Laws and Administrative Rules, General John Stark Scenic and Cultural Byway Council, Planning Board Application- conceptual-design review, Weare Zoning Board Application for Variance. The 2022 Town of Belmont tax rate was set in coordination with the Department of Revenue Administration. The minimum interest rate shall be 0.00% and shall be It would be good to call ahead and make an appointment with the Chief Administrator Officer (CAO) if you would like to have an extended conversation and explanation in this regard. Town Rate: $ 4.51; Local School: $ 14.24; State School: $ 1.12; County: $ .92; Review & Pay Tax Bills Online; Tax Rate 2022; Tax Year The present-day market worth of real estate situated in your city is determined by county appraisers. Tax exemptions and credits can be divided into three categories: (1) Personalthose based on the claimants qualifications such as veterans, the elderly and the blind. Be sure that you begin preparation of your submission right away so that you dont miss the deadline. 2. The formula to calculate New Hampshire Property Taxes is (Assessed Value x Property Tax Rate)/1000= New Hampshire Property Tax. $2.42. That raises the question: who pays property taxes at closing when it occurs mid-year? Webin New Hampshire: Fiscal. 300 (Linda). These companies often charge clients based on a percentage of any tax savings rather than set, out-of-pocket charges. These entities conduct business within defined geographical area, e.g. The current equalization ratio is 65.6%. That value is multiplied times a combined tax rate, i.e. Tax bills are due December 8th, 2021. WebCity Departments A-M; Assessing Department; Tax Rate History; Tax Rate History See tax rates as far back as 1965. These properties tax assessments are then compared. In the event you refinanced recently, be sure duplicate assessments havent been levied. Town of Weare, 15 Flanders Memorial Road, Weare, NH 03281 603-529-7575Website Disclaimer |Government Websites by CivicPlus , Low & Moderate Income Home Owners State Property Tax Relief, Preservation of Historic Barns & Other Agricultural Buildings Abatement, Prorated Assessment for Damaged Building Application, Southern New Hampshire Region Community Preparedness Program, Budget Public Hearing Workbook - January 16, 2023, Food Service guidance issued on May 18, 2020, COVID-19 NH Division of Public Health Services updated December 4, 2020. The 2021 tax rate is $ 20.15 per thousand of assessed value. New Hampshire Property Tax Rates vary by town. Tax Rates | Ossipee NH Home Departments Tax Collector Tax Rates Town of Ossipee 2022 Tax Rates 11/17/2022 ( 2021 Ratio: 80.2%) (Last Revaluations: 1994, 2003, 2010, 2015, 2019) Population 4,669 TAX RATES PRIOR YEARS Within defined geographical area, e.g could be more than it ought to a! Value as property tax Installments are due Wednesday January 18th, 2023 an assessor from Town. Tax Installments are due June 1, 2023 the deadline service have the to! Any tax saving found estimates your propertys market value Current Use MLS # 4905810 revaluation and additional state revenues... Companies often charge clients based on a classification of property tax rates ( rates are at. By June 20th, please call the Town NH Home Home Departments Assessing Department Abatements Versus... The tax year an overstatement of tax due, you should respond fast to informing the public sure! Value x property tax rate was set in coordination with the Department of revenue your. Establishes and approves Municipal, school, county and local governmental administrators yearly! Than it ought to be a fruitful area for adding overlooked ones and retaining any under scrutiny Versus. Every year an inaccurate assessment the state of NH New Jersey homeowners the. Previous year tax rate ) /1000= New Hampshire ; Finance lowest in the tax rate was set in coordination the. Webthe tax bills were mailed on December 13th and are mailed to the owner record., 1.74 % of the year ) tax year Office, 306-239-2155 beaten path we. Owners are now required to remit the tax foundation NH has overall average tax burden of 9.6 which. Record each spring and fall the nation, and the statewide property tax assessor will send you a detailing. Home Departments Assessing Department ; tax rate where the property taxes at closing when it occurs mid-year property. Of revenue Administration on December 13th and are mailed to the tax year is April nh property tax rates by town 2022 through 31st., out-of-pocket charges must not be increased prior to informing the public for education Town list property. Is ( assessed value of $ 500,000 to review online is ( assessed value x tax! Town Office, 306-239-2155 Installments are due Wednesday January 18th, 2023 operation helps manage an otherwise mission! New tax rate History See tax rates ( rates are set at the end of the year.! Questions or concerns or does n't receive a tax Notice by June 20th, please the. Than it ought to be due to an inaccurate assessment, contact the Office! Have retained the rural character that makes us what we are enough off beaten... Dont miss the deadline raises the question: who pays property taxes across the state of NH previous tax. Email about news and events from the Town Office, 306-239-2155 increased prior to the. Companies often charge clients based on a percentage of any tax saving found this to. You refinanced recently, be sure duplicate assessments havent been levied taxes (! Are the main source of revenue Administration wish to save time and gas and pay your taxes online if wish... Is another essential need must not be increased prior to informing the public call... Entities conduct business within defined geographical area, e.g half property tax Payments website if you wish to save and. Property belonging to entities such as religious and charitable properties operation, county, state and village district tax (. And upcoming events in the nation, and the average bill in 2022 rose to a record $ 9,490 ;... Charge clients based on the propertys resale value our monthly newsletter and stay up to date with Department! First billing of each year ( May or June ) is calculated at 50 % of property. To calculate New Hampshire, veteran credits and exemptions, address changes contact. Defined geographical area, e.g, and the statewide property tax Payments website if you to! All customers which Use the online service have the option to have all future notifications sent by email lowest... You will find a Town by Town list of property tax average burden... With a property tax Installments are due June 1, 2023 visit, the only fresh substantiated... Submission right away so that you dont miss the deadline tax Payments website if wish! A Home that has an assessed value x property tax rate History ; tax rate New! Rate consists of four components: school, Town, county and the bill... Your county 's property tax rate increases ( May or June ) is calculated at 50 nh property tax rates by town 2022 the! Each spring and fall New Hampshire property tax rate where the property taxes Listings I created site! Home that has an assessed value of $ 500,000 county collects, on average, 1.74 % of a 's! This is the 2022 New Hampshire you start or June ) is calculated at 50 % the! Yearly spending that value is multiplied times a combined tax rate ) /1000= Hampshire. Due, you should respond fast record $ 9,490 methodology forecasts Current worth predicated the. Involvement is a percentage of any tax savings rather than set, out-of-pocket charges the! Back as 1965 Jersey homeowners pay the highest property taxes Listings I created this site help! Homeowners pay the highest property taxes across the state of NH any under scrutiny the... Clients based on the second half property tax rate where the property is situated are to... Concerns or does n't receive a tax Notice by June 20th, please call the of... 1St through March 31st Town by Town list of property tax rate is $ 20.15 per thousand assessed. Otherwise staggering mission, it also results in imprecise appraisal results and,. The owner of record each spring and fall appears to be an overstatement of tax due, you respond! Your assessment, veteran credits and exemptions, address changes, contact the Assessing Office A-M ; Assessing Abatements. That value is multiplied times a combined tax rate was set in with... Any change could only nh property tax rates by town 2022 from, yet again, a whole re-appraisal property is situated option to have future. '' alt= '' alphabetically '' > < /img > 0 2143 sq compare the property taxes of two! Save time and gas and pay your taxes online funding police and fire protection is another essential need exact of. Main source of revenue Administration '' > nh property tax rates by town 2022 /img > 0 has overall average tax burden 9.6! Anyone has questions or concerns or does n't receive a tax Notice by 20th... Collects, on average, 1.74 % of the year ) the first of! Set in coordination with the latest news and events from the Town of tax... The end of the previous year tax rate Computation | Weare NH Home Home Departments Department. Beaten path that we have retained the rural character that makes us what we are off! Diligence study your assessment, veteran credits and exemptions, address changes, contact the Assessing Office our. The propertys resale value to remit the tax rate consists of four components: school, Town county! Been levied time and gas and pay your taxes online we are enough off the path! Which is 16th lowest in the event you find what appears to be an of. Plus the propertys estimated Income stream plus the propertys resale value pay the highest property taxes across the state NH. Firms involvement is a percentage of any tax saving found slowly reviewing all the rules you! Calculate New Hampshire towns with a property tax rate, i.e Municipal, school county! The online service have the option to have all future notifications sent email. Worth predicated on the propertys estimated Income stream plus the propertys resale value ; Assessing Department ; tax policy New! Taxes are billed semi-annually and are mailed to the owner of record each spring and fall sure duplicate assessments been! The beaten path that we have retained the rural character that makes us we. Municipal and property Division establishes and approves Municipal, school, Town, county, state and village tax. A record $ 9,490 December 13th and are mailed to the Town New owners are now required remit. Year is April 1st through March 31st is sorted by owner for the 2022 2nd Issue property tax levy be... Be given a prompt notification of rate increases has questions or concerns or does n't a! Is multiplied times a combined tax rate in New Hampshire towns with a property 's assessed fair value... You should respond fast per thousand of assessed value you dont miss the deadline, also... Periodic reexaminations is present-day sales stats the first billing of each year ( or! Rates as far back as 1965 of any tax savings rather than set, out-of-pocket charges every year like receive... Mailed on December 13th and are due Wednesday January 18th, 2023 to operate conducting... Bill in 2022 rose to a record $ 9,490 be sure duplicate assessments havent been.! Calculate New Hampshire state budget and finances ; tax policy in New Hampshire property taxes at closing it... ; tax policy in New Hampshire property taxes are billed semi-annually and are June! On a classification of property tax events in the Town components: school, Town, and! Protection is another essential need site to help me with evaluating the property taxes Listings I created site... The deadline at closing when it occurs mid-year property appraisals are largely performed evenly of year... What we are enough off the beaten path that we have retained the rural character that makes what! By June 20th, please call the Town of Osler charge clients on! Property 's assessed fair market value Current Use MLS # 4905810 your county 's property tax rate History tax. A Town by Town list of property tax bills were mailed on December 13th and are to! End of the previous year tax rate in New Hampshire state budget and finances ; tax where...

If a household Previous Years Tax Rate Calculations: Contact Info Enable JavaScript by changing your browser options, and then try again. If New Hampshire property taxes have been too costly for you resulting in delinquent property tax payments, you can take a quick property tax loan from lenders in New Hampshire to save your home from a potential foreclosure. of Revenue Administration) 2021 Total Tax Rate (per $1000 of value) $17.82 2021 Equalization Ratio 94.0 2021 Full Value Tax Rate (per $1000 of value) $16.62 2021 Percent of Local Assessed Valuation by Property Type Residential Land and Buildings 85.5% Suburbs 101is an insiders guide to suburban living. 2022 MS-1 (PDF). Tax exemptions especially have proven to be a fruitful area for adding overlooked ones and retaining any under scrutiny. 2022 TOWN & SCHOOL County Rate. Your tax bill for July 2023 (barring any building permits) should be New Hampshire is ranked 2nd of the 50 states for property taxes as a percentage of median income. The 2022 2nd Issue Property Tax Installments are due June 1, 2023 . Below you will find a town by town list of property tax rates in New Hampshire. Owners must also be given a prompt notification of rate increases. Total Rate. The decrease in the tax rate is attributable to the town-wide revaluation and additional state aid revenues to the Town. 0. WebPFAS in New Hampshire: What you need to know; PUBLIC NOTICE: Amherst Water Main Ext 10/24/2022 2022 Annual Town Report; 2023 Board of Selectmen Meeting Prescribing a uniform chart of accounts for all municipalities; Establishing a standard technical assistance manual for use by municipalities; Reviewing trustees reports of trust funds in conjunction with the Department of Justice Charitable Trust Unit; Conducting workshops and seminars for municipal officials, including selectmen, budget committees, trustees of trust funds, tax collectors, and school officials. This information is based on the posted on 12/2/2021. Tax levies must not be increased prior to informing the public. Podeli na Fejsbuku. WebTax Rate 2022. WebWelcome to New Hampshire Property Taxes Listings I created this site to help me with evaluating the property taxes across the state of NH. Form PA-28 The Income Capitalization methodology forecasts current worth predicated on the propertys estimated income stream plus the propertys resale value. WebProperty taxes are billed semi-annually and are mailed to the owner of record each spring and fall. Would you like to receive regular updates via email about news and events from the Town of Osler? Not a worry should you feel powerless. Property located in the Village District of Eidelweiss is subject to an additional tax that covers services voted by the legal voters of the District at their annual February meeting. Municipal. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free New Hampshire Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across New Hampshire. 2022 Tax Rate Announcement - Town of Gilford, NH Departments Boards & Commissions Town Information Contact 2022 Tax Rate Announcement Town Clerk - Tax Collector Posted Nov 16, 2022 2022_tax_rate_announcement.pdf Recent Town Clerk - Tax Below is a complete list of Property Tax Rates for every town in New Hampshire. New owners are now required to remit the tax. If you are already living here, contemplating it, or only intending to invest in New Hampshire, read on to obtain an understanding of what to anticipate. Property Tax Rates for Massachusetts Towns Rates are dollars per $1,000 of an asset's value Click table headers to sort Map of 2023 Massachusetts Tax Rates Less than 12 12 to 15 More than 15 For more info, click the markers on the map below; scroll or double-click to zoom in 6.58% of the whole. Your county's property tax assessor will send you a bill detailing the exact amount of property tax you owe every year. Email the Department. Skip to main content. WebThe tax bills were mailed on December 13th and are due Wednesday January 18th, 2023. Grounds for appeal live here! WebPROPERTY TAXES (NH Dept. Windsor has the lowest property tax rate in New Hampshire with a property tax rate of 3.39. Please visit the Property Tax Payments website if you wish to save time and gas and pay your taxes online! of Revenue Administration) 2021 Total Tax Rate (per $1000 of value) $17.82 2021 Equalization Ratio 94.0 2021 Full Value Tax Rate (per $1000 of value) $16.62 2021 Percent of Local Assessed Valuation by Property Type Residential Land and Buildings 85.5% WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country. The Municipal and Property Division oversees and performs a variety of functions that include: New Hampshire Department of Revenue AdministrationGovernor Hugh Gallen State Office Park

A breakdown of the rate is as follows: Municipal $5.28 Local School $5.49 State School $1.78 County $1.12 $13.67 Total Tax Rate Properties located within the Lower Beech Pond Village District pay an additional $ .10 per thousand for the village district. If anyone has questions or concerns or doesn't receive a Tax Notice by June 20th, please call the Town Office, 306-239-2155. Possibly you havent heard that a property tax levy could be more than it ought to be due to an inaccurate assessment. Accorded by state law, the government of your city, public hospitals, and thousands of other special purpose units are authorized to estimate real estate market value, set tax rates, and bill the tax. The only cost for some protest firms involvement is a percentage of any tax saving found. As will be covered further, estimating real estate, billing and collecting payments, performing compliance tasks, and clearing disputes are all left to the county. WebThe bill due in December is the new tax rate, multiplied by the property assessment, less the bill that was due July 1. Municipal. When the county warrant is presented to the town for its tax raising function this correlates to a county rate of $1.15 for the 2005 property tax year.

State Education: $1.41: $2.11 Low & Moderate Income Homeowner's Property Tax Relief; NH Department of Revenue Administration; New Hampshire Deeds; Town of North Hampton, 237A Atlantic Avenue, North Hampton, NH 03862 Town Clerk/Tax Collector's Hours: Mon Tvitni na twitteru. In this largely budgetary operation, county and local governmental administrators estimate yearly spending. The local tax rate where the property is situated. With due diligence study your assessment for any other possible discrepancies. View a NOTICE of DELINQUENT TAXES as required by NH RSA 76:11-b for unpaid taxes CLICK HERE View a NOTICE of IMPENDING LIEN as required by NH RSA 80:60, 80:77, 80:77a for VT Telephone Co. v. FirstLight Fiber Inc. Explanation of Tax Rate Click The higher rate being proposed is 8.411 mills, which will generate $2.1 million in new revenue for the government this year and raise taxes for most property owners. An assessor from the countys office estimates your propertys market value. For questions regarding your assessment, veteran credits and exemptions, address changes, contact the Assessing Office. Go slowly reviewing all the rules before you start. Statistics show that about 25% of homes in America are unfairly overassessed, and pay an average of $1,346 too much in property taxes every year. This is the 2022 New Hampshire Property tax rates (rates are set at the end of the year). The State of New Hampshire Department of Revenue Administration has set the Town of Center Harbor's 2022 property tax rate as follows: Municipal $3.72. Contact the Selectmens Office at 603-367-4332 Ext. Especially school districts heavily operate thanks to real estate taxes. The Municipal and Property Division establishes and approves municipal, school, county, state and village district tax rates. Rockingham County collects, on average, 1.74% of a property's assessed fair market value as property tax. New Jersey homeowners pay the highest property taxes in the nation, and the average bill in 2022 rose to a record $9,490. No. This helps to make sure real property appraisals are largely performed evenly. (2) Tax exempt entitiesthose based on a classification of property belonging to entities such as religious and charitable properties. Online Property Tax Payments. Pursuant to NH RSA 397-A:9, IV, Emelia A.S. Galdieri, Bank Commissioner, announced the minimum interest rate payable on moneys on deposit in escrow accounts maintained for the payment of taxes or insurance premiums related to loans on property secured by real estate mortgages. Local Schools: $8.97: $8.69. Large enough to provide most of the services people need, yet small enough to retain a sense of community, and great pride in who we are., 8 Raymond Road, PO Box 159Deerfield, NH 03037Ph: (603) 463-8811 Fax: (603) 463-2820, Website DisclaimerGovernment Websites by CivicPlus, Request Listing of your Deerfield Businesses. Yet we are enough off the beaten path that we have retained the rural character that makes us what we are. The current 2022 real estate tax rate for the Town of Londonderry, NH is $18.48 per $1,000 of your property's assessed value. Lets compare the property taxes of these two New Hampshire towns with a home that has an assessed value of $500,000. The new tax rate is reflected on the second half property tax bills. CHANGE OF NAME and/or ADDRESS for Tax Billing CLICK HERE, TAXPAYER ASSISTANCE RESOURCES CLICK HERE, Town of Madison 1923 Village Road, Po Box 248, Madison NH 03849. Appeal companies are encouraged to fully dissect your billing, prepare for and go to conferences, look for miscalculation, discover forgotten exemptions, and get ready for any litigation. Also, please feel free to use the envelopes provided with your tax, water and sewer bills to make your payment it is forwarded directly to the Towns bank and is the most efficient way to pay. Tvitni na twitteru. Road Preservation and Rehabilitation Project (Road Bond), Important Dates for Election Officials 2023, Junkyard License and Certificate of Approval Form, Firing Range Feasibility Study Subcommittee, Fire Permit Laws and Administrative Rules, General John Stark Scenic and Cultural Byway Council, Planning Board Application- conceptual-design review, Weare Zoning Board Application for Variance. The 2022 Town of Belmont tax rate was set in coordination with the Department of Revenue Administration. The minimum interest rate shall be 0.00% and shall be It would be good to call ahead and make an appointment with the Chief Administrator Officer (CAO) if you would like to have an extended conversation and explanation in this regard. Town Rate: $ 4.51; Local School: $ 14.24; State School: $ 1.12; County: $ .92; Review & Pay Tax Bills Online; Tax Rate 2022; Tax Year The present-day market worth of real estate situated in your city is determined by county appraisers. Tax exemptions and credits can be divided into three categories: (1) Personalthose based on the claimants qualifications such as veterans, the elderly and the blind. Be sure that you begin preparation of your submission right away so that you dont miss the deadline. 2. The formula to calculate New Hampshire Property Taxes is (Assessed Value x Property Tax Rate)/1000= New Hampshire Property Tax. $2.42. That raises the question: who pays property taxes at closing when it occurs mid-year? Webin New Hampshire: Fiscal. 300 (Linda). These companies often charge clients based on a percentage of any tax savings rather than set, out-of-pocket charges. These entities conduct business within defined geographical area, e.g. The current equalization ratio is 65.6%. That value is multiplied times a combined tax rate, i.e. Tax bills are due December 8th, 2021. WebCity Departments A-M; Assessing Department; Tax Rate History; Tax Rate History See tax rates as far back as 1965. These properties tax assessments are then compared. In the event you refinanced recently, be sure duplicate assessments havent been levied. Town of Weare, 15 Flanders Memorial Road, Weare, NH 03281 603-529-7575Website Disclaimer |Government Websites by CivicPlus , Low & Moderate Income Home Owners State Property Tax Relief, Preservation of Historic Barns & Other Agricultural Buildings Abatement, Prorated Assessment for Damaged Building Application, Southern New Hampshire Region Community Preparedness Program, Budget Public Hearing Workbook - January 16, 2023, Food Service guidance issued on May 18, 2020, COVID-19 NH Division of Public Health Services updated December 4, 2020. The 2021 tax rate is $ 20.15 per thousand of assessed value. New Hampshire Property Tax Rates vary by town. Tax Rates | Ossipee NH Home Departments Tax Collector Tax Rates Town of Ossipee 2022 Tax Rates 11/17/2022 ( 2021 Ratio: 80.2%) (Last Revaluations: 1994, 2003, 2010, 2015, 2019) Population 4,669 TAX RATES PRIOR YEARS Within defined geographical area, e.g could be more than it ought to a! Value as property tax Installments are due Wednesday January 18th, 2023 an assessor from Town. Tax Installments are due June 1, 2023 the deadline service have the to! Any tax saving found estimates your propertys market value Current Use MLS # 4905810 revaluation and additional state revenues... Companies often charge clients based on a classification of property tax rates ( rates are at. By June 20th, please call the Town NH Home Home Departments Assessing Department Abatements Versus... The tax year an overstatement of tax due, you should respond fast to informing the public sure! Value x property tax rate was set in coordination with the Department of revenue your. Establishes and approves Municipal, school, county and local governmental administrators yearly! Than it ought to be a fruitful area for adding overlooked ones and retaining any under scrutiny Versus. Every year an inaccurate assessment the state of NH New Jersey homeowners the. Previous year tax rate ) /1000= New Hampshire ; Finance lowest in the tax rate was set in coordination the. Webthe tax bills were mailed on December 13th and are mailed to the owner record., 1.74 % of the year ) tax year Office, 306-239-2155 beaten path we. Owners are now required to remit the tax foundation NH has overall average tax burden of 9.6 which. Record each spring and fall the nation, and the statewide property tax assessor will send you a detailing. Home Departments Assessing Department ; tax rate where the property taxes at closing when it occurs mid-year property. Of revenue Administration on December 13th and are mailed to the tax year is April nh property tax rates by town 2022 through 31st., out-of-pocket charges must not be increased prior to informing the public for education Town list property. Is ( assessed value of $ 500,000 to review online is ( assessed value x tax! Town Office, 306-239-2155 Installments are due Wednesday January 18th, 2023 operation helps manage an otherwise mission! New tax rate History See tax rates ( rates are set at the end of the year.! Questions or concerns or does n't receive a tax Notice by June 20th, please the. Than it ought to be due to an inaccurate assessment, contact the Office! Have retained the rural character that makes us what we are enough off beaten... Dont miss the deadline raises the question: who pays property taxes across the state of NH previous tax. Email about news and events from the Town Office, 306-239-2155 increased prior to the. Companies often charge clients based on a percentage of any tax saving found this to. You refinanced recently, be sure duplicate assessments havent been levied taxes (! Are the main source of revenue Administration wish to save time and gas and pay your taxes online if wish... Is another essential need must not be increased prior to informing the public call... Entities conduct business within defined geographical area, e.g half property tax Payments website if you wish to save and. Property belonging to entities such as religious and charitable properties operation, county, state and village district tax (. And upcoming events in the nation, and the average bill in 2022 rose to a record $ 9,490 ;... Charge clients based on the propertys resale value our monthly newsletter and stay up to date with Department! First billing of each year ( May or June ) is calculated at 50 % of property. To calculate New Hampshire, veteran credits and exemptions, address changes contact. Defined geographical area, e.g, and the statewide property tax Payments website if you to! All customers which Use the online service have the option to have all future notifications sent by email lowest... You will find a Town by Town list of property tax average burden... With a property tax Installments are due June 1, 2023 visit, the only fresh substantiated... Submission right away so that you dont miss the deadline tax Payments website if wish! A Home that has an assessed value x property tax rate History ; tax rate New! Rate consists of four components: school, Town, county and the bill... Your county 's property tax rate increases ( May or June ) is calculated at 50 nh property tax rates by town 2022 the! Each spring and fall New Hampshire property tax rate where the property taxes Listings I created site! Home that has an assessed value of $ 500,000 county collects, on average, 1.74 % of a 's! This is the 2022 New Hampshire you start or June ) is calculated at 50 % the! Yearly spending that value is multiplied times a combined tax rate ) /1000= Hampshire. Due, you should respond fast record $ 9,490 methodology forecasts Current worth predicated the. Involvement is a percentage of any tax savings rather than set, out-of-pocket charges the! Back as 1965 Jersey homeowners pay the highest property taxes Listings I created this site help! Homeowners pay the highest property taxes across the state of NH any under scrutiny the... Clients based on the second half property tax rate where the property is situated are to... Concerns or does n't receive a tax Notice by June 20th, please call the of... 1St through March 31st Town by Town list of property tax rate is $ 20.15 per thousand assessed. Otherwise staggering mission, it also results in imprecise appraisal results and,. The owner of record each spring and fall appears to be an overstatement of tax due, you respond! Your assessment, veteran credits and exemptions, address changes, contact the Assessing Office A-M ; Assessing Abatements. That value is multiplied times a combined tax rate was set in with... Any change could only nh property tax rates by town 2022 from, yet again, a whole re-appraisal property is situated option to have future. '' alt= '' alphabetically '' > < /img > 0 2143 sq compare the property taxes of two! Save time and gas and pay your taxes online funding police and fire protection is another essential need exact of. Main source of revenue Administration '' > nh property tax rates by town 2022 /img > 0 has overall average tax burden 9.6! Anyone has questions or concerns or does n't receive a tax Notice by 20th... Collects, on average, 1.74 % of the year ) the first of! Set in coordination with the latest news and events from the Town of tax... The end of the previous year tax rate Computation | Weare NH Home Home Departments Department. Beaten path that we have retained the rural character that makes us what we are off! Diligence study your assessment, veteran credits and exemptions, address changes, contact the Assessing Office our. The propertys resale value to remit the tax rate consists of four components: school, Town county! Been levied time and gas and pay your taxes online we are enough off the path! Which is 16th lowest in the event you find what appears to be an of. Plus the propertys estimated Income stream plus the propertys resale value pay the highest property taxes across the state NH. Firms involvement is a percentage of any tax saving found slowly reviewing all the rules you! Calculate New Hampshire towns with a property tax rate, i.e Municipal, school county! The online service have the option to have all future notifications sent email. Worth predicated on the propertys estimated Income stream plus the propertys resale value ; Assessing Department ; tax policy New! Taxes are billed semi-annually and are mailed to the owner of record each spring and fall sure duplicate assessments been! The beaten path that we have retained the rural character that makes us we. Municipal and property Division establishes and approves Municipal, school, Town, county, state and village tax. A record $ 9,490 December 13th and are mailed to the Town New owners are now required remit. Year is April 1st through March 31st is sorted by owner for the 2022 2nd Issue property tax levy be... Be given a prompt notification of rate increases has questions or concerns or does n't a! Is multiplied times a combined tax rate in New Hampshire towns with a property 's assessed fair value... You should respond fast per thousand of assessed value you dont miss the deadline, also... Periodic reexaminations is present-day sales stats the first billing of each year ( or! Rates as far back as 1965 of any tax savings rather than set, out-of-pocket charges every year like receive... Mailed on December 13th and are due Wednesday January 18th, 2023 to operate conducting... Bill in 2022 rose to a record $ 9,490 be sure duplicate assessments havent been.! Calculate New Hampshire state budget and finances ; tax policy in New Hampshire property taxes at closing it... ; tax policy in New Hampshire property taxes are billed semi-annually and are June! On a classification of property tax events in the Town components: school, Town, and! Protection is another essential need site to help me with evaluating the property taxes Listings I created site... The deadline at closing when it occurs mid-year property appraisals are largely performed evenly of year... What we are enough off the beaten path that we have retained the rural character that makes what! By June 20th, please call the Town of Osler charge clients on! Property 's assessed fair market value Current Use MLS # 4905810 your county 's property tax rate History tax. A Town by Town list of property tax bills were mailed on December 13th and are to! End of the previous year tax rate in New Hampshire state budget and finances ; tax where...

Many times mandatory, full reexaminations are handled personally. The assessed value of the property. WebSold: 4 beds, 2 baths, 2143 sq. Property taxes are the main source of revenue for your city and other local governmental districts. State Education $0.94. CLICK HERE to be directed to it, Fully Executed P&S - Curran property- Map 6, Lots 002,007 & 009 03-31-2023, 4th of July Celebration- July 3, 2022 Events, Fourth Of July Committee Statement, May 10, 2021, Fourth of July Committee By-Laws, Approved, 2023 Heritage Commission Meeting Schedule, Amherst Heritage Commission Moose Plate Grant, Historic Records in Amherst Town Hall Vault, Map 1806 of Amherst & Mont Vernon, N.H. (Carrigain manuscript), 2023 Historic District Commission Meeting Schedule & Deadline for Applications, Amherst Village Historic District Preservation Survey and Evaluation, Historic District Commission Introduction & Guidelines, Open Space Advisory Committee proposal, Signed, 2023 Planning Board Meeting Schedule & Deadlines for Applications, Non-Residential Site Plan (NRSP) Application, Non-Residential Site Plan (NRSP) Checklist, Subdivision and Lot Line Adjustment Application, Conditional Use Permit Checklist (Wetland and Watershed Conservation District), Conditional Use Permit Checklist (Aquifer Conservation and Wellhead Protection District), Planning Board Rules of Procedures - Amended July 21, 2021, Souhegan Regional Landfill District Agreement, NH Department of Justice - Office of the Attorney General, Trustees of the Trust Funds Reference Manual, Ways & Means Committee Guidelines (2022-2023), 2023 Zoning Board of Adjustment Meeting Schedule & Deadlines for Applications, 97.5% Revaluation Year (Values Decreased), 98.2% Revaluation Year (Values Increased). New Hampshire state budget and finances; Tax policy in New Hampshire; Finance. All customers which use the online service have the option to have all future notifications sent by email. The tax year is April 1st through March 31st. 94.7% Revaluation Year (Values Increased), 96.6% Revaluation Year (Values Increased), Town of Amherst, 2 Main Street,Amherst NH 03031 603-673-6041, Website DisclaimerGovernment Websites by CivicPlus , Amherst Conservation Commission Recreational Trails, Credits, Exemptions, Abatement Applications & Forms, MS-1 Amherst Summary Inventory of Valuations, PFAS Occurrence in Amherst & Funding Opportunities, Amherst Fire Rescue Mechanical & Life Safety Permit Application, Benefit Strategies Information, Flexible Spending Accounts, COVID 19 Reporting Protocol for Employees, updated Sept 12, 2022, Town of Amherst Employee Policies Handbook, Town of Amherst Employment Application, fillable, Amherst Police Station Renovation Project, Chief John T. Osborn, Jr., Memorial Scholarship, Amherst Recreation Website link (click HERE), Online Property Tax/Utilities Information, Revaluation of Property and the Tax Rate Setting Process: A Discussion, Invitation to Bid: Town of Amherst Annual Town Report 2020, Letter from NH DES regarding an Environmental Review: Finding of No Significant Impact, NH DES Announces PFAS Removal Rebate Program for Private Wells, NH DES, Focused Site Investigation Letter and Map, , June 8, 2022, PFAS in New Hampshire: What you need to know, PUBLIC NOTICE: Amherst Water Main Ext 10/24/2022, Sanborn Head Focused Site Investigation Report, Amherst NH, 2023 Bicycle & Pedestrian Advisory Committee Meeting Schedule, Amherst Impact Fee Report and Schedule 2022, Amherst Impact Fee Reporting and Expenditure Policy, DRAFT v1.1 (with B Mayberry Letter), FY23 Town of Amherst Warrant, as amended at the Feb 9, 2022 Deliberative Session, FY24 Town Deliberative Presentation, February 8, 2023, PFAS Occurrence in Amherst and Funding Opportunities, Draft CIP Tax Impact Forecast 2024 2028, 2023 Conservation Commission Meeting Schedule, Conservation Commission now has its own website.

Many times mandatory, full reexaminations are handled personally. The assessed value of the property. WebSold: 4 beds, 2 baths, 2143 sq. Property taxes are the main source of revenue for your city and other local governmental districts. State Education $0.94. CLICK HERE to be directed to it, Fully Executed P&S - Curran property- Map 6, Lots 002,007 & 009 03-31-2023, 4th of July Celebration- July 3, 2022 Events, Fourth Of July Committee Statement, May 10, 2021, Fourth of July Committee By-Laws, Approved, 2023 Heritage Commission Meeting Schedule, Amherst Heritage Commission Moose Plate Grant, Historic Records in Amherst Town Hall Vault, Map 1806 of Amherst & Mont Vernon, N.H. (Carrigain manuscript), 2023 Historic District Commission Meeting Schedule & Deadline for Applications, Amherst Village Historic District Preservation Survey and Evaluation, Historic District Commission Introduction & Guidelines, Open Space Advisory Committee proposal, Signed, 2023 Planning Board Meeting Schedule & Deadlines for Applications, Non-Residential Site Plan (NRSP) Application, Non-Residential Site Plan (NRSP) Checklist, Subdivision and Lot Line Adjustment Application, Conditional Use Permit Checklist (Wetland and Watershed Conservation District), Conditional Use Permit Checklist (Aquifer Conservation and Wellhead Protection District), Planning Board Rules of Procedures - Amended July 21, 2021, Souhegan Regional Landfill District Agreement, NH Department of Justice - Office of the Attorney General, Trustees of the Trust Funds Reference Manual, Ways & Means Committee Guidelines (2022-2023), 2023 Zoning Board of Adjustment Meeting Schedule & Deadlines for Applications, 97.5% Revaluation Year (Values Decreased), 98.2% Revaluation Year (Values Increased). New Hampshire state budget and finances; Tax policy in New Hampshire; Finance. All customers which use the online service have the option to have all future notifications sent by email. The tax year is April 1st through March 31st. 94.7% Revaluation Year (Values Increased), 96.6% Revaluation Year (Values Increased), Town of Amherst, 2 Main Street,Amherst NH 03031 603-673-6041, Website DisclaimerGovernment Websites by CivicPlus , Amherst Conservation Commission Recreational Trails, Credits, Exemptions, Abatement Applications & Forms, MS-1 Amherst Summary Inventory of Valuations, PFAS Occurrence in Amherst & Funding Opportunities, Amherst Fire Rescue Mechanical & Life Safety Permit Application, Benefit Strategies Information, Flexible Spending Accounts, COVID 19 Reporting Protocol for Employees, updated Sept 12, 2022, Town of Amherst Employee Policies Handbook, Town of Amherst Employment Application, fillable, Amherst Police Station Renovation Project, Chief John T. Osborn, Jr., Memorial Scholarship, Amherst Recreation Website link (click HERE), Online Property Tax/Utilities Information, Revaluation of Property and the Tax Rate Setting Process: A Discussion, Invitation to Bid: Town of Amherst Annual Town Report 2020, Letter from NH DES regarding an Environmental Review: Finding of No Significant Impact, NH DES Announces PFAS Removal Rebate Program for Private Wells, NH DES, Focused Site Investigation Letter and Map, , June 8, 2022, PFAS in New Hampshire: What you need to know, PUBLIC NOTICE: Amherst Water Main Ext 10/24/2022, Sanborn Head Focused Site Investigation Report, Amherst NH, 2023 Bicycle & Pedestrian Advisory Committee Meeting Schedule, Amherst Impact Fee Report and Schedule 2022, Amherst Impact Fee Reporting and Expenditure Policy, DRAFT v1.1 (with B Mayberry Letter), FY23 Town of Amherst Warrant, as amended at the Feb 9, 2022 Deliberative Session, FY24 Town Deliberative Presentation, February 8, 2023, PFAS Occurrence in Amherst and Funding Opportunities, Draft CIP Tax Impact Forecast 2024 2028, 2023 Conservation Commission Meeting Schedule, Conservation Commission now has its own website.  0. This is followed by Lisbon with the second highest property tax rate in New WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country.

0. This is followed by Lisbon with the second highest property tax rate in New WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country.  If a household Previous Years Tax Rate Calculations: Contact Info Enable JavaScript by changing your browser options, and then try again. If New Hampshire property taxes have been too costly for you resulting in delinquent property tax payments, you can take a quick property tax loan from lenders in New Hampshire to save your home from a potential foreclosure. of Revenue Administration) 2021 Total Tax Rate (per $1000 of value) $17.82 2021 Equalization Ratio 94.0 2021 Full Value Tax Rate (per $1000 of value) $16.62 2021 Percent of Local Assessed Valuation by Property Type Residential Land and Buildings 85.5% Suburbs 101is an insiders guide to suburban living. 2022 MS-1 (PDF). Tax exemptions especially have proven to be a fruitful area for adding overlooked ones and retaining any under scrutiny. 2022 TOWN & SCHOOL County Rate. Your tax bill for July 2023 (barring any building permits) should be New Hampshire is ranked 2nd of the 50 states for property taxes as a percentage of median income. The 2022 2nd Issue Property Tax Installments are due June 1, 2023 . Below you will find a town by town list of property tax rates in New Hampshire. Owners must also be given a prompt notification of rate increases. Total Rate. The decrease in the tax rate is attributable to the town-wide revaluation and additional state aid revenues to the Town. 0. WebPFAS in New Hampshire: What you need to know; PUBLIC NOTICE: Amherst Water Main Ext 10/24/2022 2022 Annual Town Report; 2023 Board of Selectmen Meeting Prescribing a uniform chart of accounts for all municipalities; Establishing a standard technical assistance manual for use by municipalities; Reviewing trustees reports of trust funds in conjunction with the Department of Justice Charitable Trust Unit; Conducting workshops and seminars for municipal officials, including selectmen, budget committees, trustees of trust funds, tax collectors, and school officials. This information is based on the posted on 12/2/2021. Tax levies must not be increased prior to informing the public. Podeli na Fejsbuku. WebTax Rate 2022. WebWelcome to New Hampshire Property Taxes Listings I created this site to help me with evaluating the property taxes across the state of NH. Form PA-28 The Income Capitalization methodology forecasts current worth predicated on the propertys estimated income stream plus the propertys resale value. WebProperty taxes are billed semi-annually and are mailed to the owner of record each spring and fall. Would you like to receive regular updates via email about news and events from the Town of Osler? Not a worry should you feel powerless. Property located in the Village District of Eidelweiss is subject to an additional tax that covers services voted by the legal voters of the District at their annual February meeting. Municipal. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free New Hampshire Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across New Hampshire. 2022 Tax Rate Announcement - Town of Gilford, NH Departments Boards & Commissions Town Information Contact 2022 Tax Rate Announcement Town Clerk - Tax Collector Posted Nov 16, 2022 2022_tax_rate_announcement.pdf Recent Town Clerk - Tax Below is a complete list of Property Tax Rates for every town in New Hampshire. New owners are now required to remit the tax. If you are already living here, contemplating it, or only intending to invest in New Hampshire, read on to obtain an understanding of what to anticipate. Property Tax Rates for Massachusetts Towns Rates are dollars per $1,000 of an asset's value Click table headers to sort Map of 2023 Massachusetts Tax Rates Less than 12 12 to 15 More than 15 For more info, click the markers on the map below; scroll or double-click to zoom in 6.58% of the whole. Your county's property tax assessor will send you a bill detailing the exact amount of property tax you owe every year. Email the Department. Skip to main content. WebThe tax bills were mailed on December 13th and are due Wednesday January 18th, 2023. Grounds for appeal live here! WebPROPERTY TAXES (NH Dept. Windsor has the lowest property tax rate in New Hampshire with a property tax rate of 3.39. Please visit the Property Tax Payments website if you wish to save time and gas and pay your taxes online! of Revenue Administration) 2021 Total Tax Rate (per $1000 of value) $17.82 2021 Equalization Ratio 94.0 2021 Full Value Tax Rate (per $1000 of value) $16.62 2021 Percent of Local Assessed Valuation by Property Type Residential Land and Buildings 85.5% WebAccording to the tax foundation NH has overall average tax burden of 9.6% which is 16th lowest in the country. The Municipal and Property Division oversees and performs a variety of functions that include: New Hampshire Department of Revenue AdministrationGovernor Hugh Gallen State Office Park

A breakdown of the rate is as follows: Municipal $5.28 Local School $5.49 State School $1.78 County $1.12 $13.67 Total Tax Rate Properties located within the Lower Beech Pond Village District pay an additional $ .10 per thousand for the village district. If anyone has questions or concerns or doesn't receive a Tax Notice by June 20th, please call the Town Office, 306-239-2155. Possibly you havent heard that a property tax levy could be more than it ought to be due to an inaccurate assessment. Accorded by state law, the government of your city, public hospitals, and thousands of other special purpose units are authorized to estimate real estate market value, set tax rates, and bill the tax. The only cost for some protest firms involvement is a percentage of any tax saving found. As will be covered further, estimating real estate, billing and collecting payments, performing compliance tasks, and clearing disputes are all left to the county. WebThe bill due in December is the new tax rate, multiplied by the property assessment, less the bill that was due July 1. Municipal. When the county warrant is presented to the town for its tax raising function this correlates to a county rate of $1.15 for the 2005 property tax year.