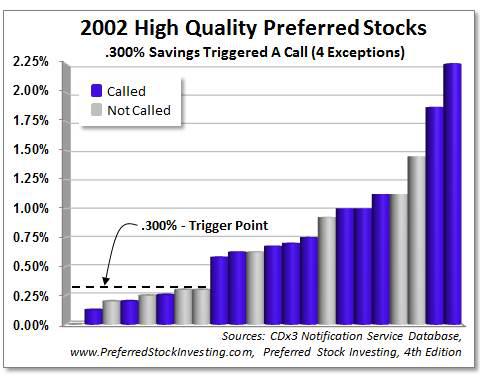

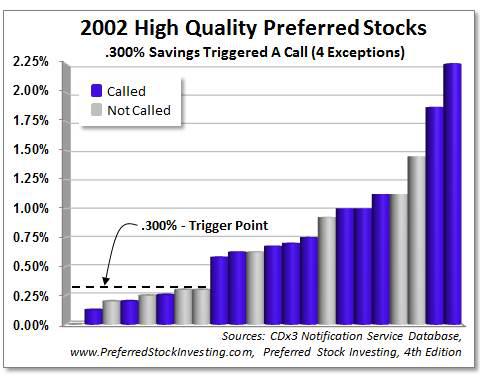

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. that you originally paid $25 per share, the same as the call price). The CDx3 Special Report "Calculating Your Rate Of Return" walks you through the entire calculation, step by step, including the setup of the Excel RATE function for your preferred stock. WebPreferred stocks are stocks which give shareholders preference over common stockholders in terms of having a fixed dividend rate and priority claim over earnings and assets in the event of a company's liquidation. If, for example, a pharmaceutical research company discovers an effective cure for the flu, its common stock will soar, while the preferreds might only increase by a few points. To date, the stock has declined by 9.4 %. As with convertible bonds, preferreds can often be converted into the common stock of the issuing company. Preference shares are company stock with dividends that are paid to shareholders before common stock dividends are paid out. Any of the three types of preferreds can include this provision in their prospectus so being convertible is not a type of preferred stock; it is a characteristic. Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Dividing this annual amount by four gives you the quarterly dividend amount that will appear in your brokerage cash account on the distribution date, in this case $0.50 per share ($2.00 divided by 4 = $0.50). Similar to bonds, preferred stock shares are issued at par value. Research article library (hosted by Seeking Alpha), - Test your The below chart shows the dividend declared over the past few quarters. These include white papers, government data, original reporting, and interviews with industry experts. Because of their characteristics, they straddle the line between stocks and bonds. millions of shares, no one in any corporate boardroom is waiting For a list of the targeted trust preferred stocks that are currently selling for less than $25 per share, including the Big Bank TRUPS that can be prematurely called, please consider subscribing to the CDx3 Notification Service today at www.PreferredStockInvesting.com. Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics. Subscription Agreement Bank preferreds have higher yields mainly because they sit lower in the banks For example, for preferred stocks from telecommunications or manufacturing to become candidates, you would have to give up the "cumulative" dividend requirement. There are manystock advisory servicesthat recommends few of the best stocks to its members and subscribers. You are going to receive the same dividend amount Although you buy or sell them the same way you trade regular stocks, preferreds are more like bonds than common stocks.  WebMaturity Date(the date when principal is generally required to be paid by an issuer) Preferred securities may have a stated maturity date, however, many are perpetual and This means that the company can buy back these preferred This is an attractive segment of the market historically reserved for private equity or other legacy players. Where common stock investors frequently look at market price trends over time to gauge market demand for a common stock, preferred stock investors have a much more direct metric that actually allows us to quantify the level of market demand for a preferred stock every quarter in much less speculative fashion. However, the fact that individuals are not eligible for such favorable tax treatment should not exclude preferreds from consideration as a viable investment. This compensation may impact how and where listings appear. Ex Date . Preferred stock, a kind of hybrid security that has characteristics of both debt and equity, is attracting more interest from investors who are seeking higher yielding investments in the current low interest rate environment. 2023

WebMaturity Date(the date when principal is generally required to be paid by an issuer) Preferred securities may have a stated maturity date, however, many are perpetual and This means that the company can buy back these preferred This is an attractive segment of the market historically reserved for private equity or other legacy players. Where common stock investors frequently look at market price trends over time to gauge market demand for a common stock, preferred stock investors have a much more direct metric that actually allows us to quantify the level of market demand for a preferred stock every quarter in much less speculative fashion. However, the fact that individuals are not eligible for such favorable tax treatment should not exclude preferreds from consideration as a viable investment. This compensation may impact how and where listings appear. Ex Date . Preferred stock, a kind of hybrid security that has characteristics of both debt and equity, is attracting more interest from investors who are seeking higher yielding investments in the current low interest rate environment. 2023

If you do not agree with these terms and conditions, please disconnect immediately from this website. We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions. The Gabelli Utility Trust has a dividend yield of 8.86 %. You'll have to report the trade when you file your taxes, and you may owe capital gains tax if you receive more than you originally paid for the stock. The InfraCap REIT Preferred ETF is the only ETF offering a diversified investment in preferred securities issued by Real Estate Investment Trusts (REITs). That's the time value of money. The company can choose to reduce dividends or pay no dividend at all in line with the companys financial position. Qualified dividend income, which is taxed at the lower long-term federal capital gains rates (0% to 20%, depending on an investors taxable income bracket, plus the 3.8% net investment income tax for high earners)1, can offer an after-tax yield pickup versus traditional corporate bonds, where the interest is taxed at federal ordinary income tax rates (up to40.8% currently). Less frequently, however, the prospectus, rather than use the term "cumulative" and assume that the reader knows what it means, will use a explanation instead. This is the Rule of Call Date Gravity from Preferred Stock Investing (page 59). Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. Individuals are encouraged to consider their own unique needs and/or specific circumstances when selecting a Financial Advisor. Perpetual preferred shares usually function like common shares.

If you do not agree with these terms and conditions, please disconnect immediately from this website. We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions. The Gabelli Utility Trust has a dividend yield of 8.86 %. You'll have to report the trade when you file your taxes, and you may owe capital gains tax if you receive more than you originally paid for the stock. The InfraCap REIT Preferred ETF is the only ETF offering a diversified investment in preferred securities issued by Real Estate Investment Trusts (REITs). That's the time value of money. The company can choose to reduce dividends or pay no dividend at all in line with the companys financial position. Qualified dividend income, which is taxed at the lower long-term federal capital gains rates (0% to 20%, depending on an investors taxable income bracket, plus the 3.8% net investment income tax for high earners)1, can offer an after-tax yield pickup versus traditional corporate bonds, where the interest is taxed at federal ordinary income tax rates (up to40.8% currently). Less frequently, however, the prospectus, rather than use the term "cumulative" and assume that the reader knows what it means, will use a explanation instead. This is the Rule of Call Date Gravity from Preferred Stock Investing (page 59). Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. Individuals are encouraged to consider their own unique needs and/or specific circumstances when selecting a Financial Advisor. Perpetual preferred shares usually function like common shares.  Most Preferred Stocks have an optional redemption period in which the shares may be redeemed. The investment seeks to provide current income. Within the spectrum of financial instruments, preferred stocks (or "preferreds") occupy a unique place. Get the latest insights, analyses and market trends in our newsletter, podcasts and videos. This rate remains the same until the stock matures, which is usually 30 years. Full stock is a stock with a par value of $100 per share. While you may be able to use this loss to offset other taxable gains, it's generally preferable to decide for yourself when you want to book a loss, rather than having a call date determine the timing. The prospectus of these securities includes a provision that allows the bank to issue a call if the government changes the rules regarding how Tier 1 Capital is calculated (which is exactly what happened when the Act was signed into law in July 2010). These are not just oil and gas producers, but include others such as shippers and service companies. The declared dividend rate is set at a level where there is a market for it at $25. Supply and demand dynamics are a notable positive for bank preferreds at this time. With preferreds, the investor is standing closer to the front of the line for payment than common shareholders, although not by much. This outcome seems unlikely in the near term as the banking sector remains soundly profitable and well capitalized with common equity. The company's obligation to pay you does not go away; they still owe you the money. Find a Financial Advisor, Branch and Private Wealth Advisor near you. PREFERRED STOCK ANNOUNCEMENT: COPPER PPTY CTL PASS THRU TR (NBB: CPPTL) today declared a preferred stock dividend of $0.1027 per share. We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals. Preferred shares normally carry no voting rights (unlike common shares). We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

Most Preferred Stocks have an optional redemption period in which the shares may be redeemed. The investment seeks to provide current income. Within the spectrum of financial instruments, preferred stocks (or "preferreds") occupy a unique place. Get the latest insights, analyses and market trends in our newsletter, podcasts and videos. This rate remains the same until the stock matures, which is usually 30 years. Full stock is a stock with a par value of $100 per share. While you may be able to use this loss to offset other taxable gains, it's generally preferable to decide for yourself when you want to book a loss, rather than having a call date determine the timing. The prospectus of these securities includes a provision that allows the bank to issue a call if the government changes the rules regarding how Tier 1 Capital is calculated (which is exactly what happened when the Act was signed into law in July 2010). These are not just oil and gas producers, but include others such as shippers and service companies. The declared dividend rate is set at a level where there is a market for it at $25. Supply and demand dynamics are a notable positive for bank preferreds at this time. With preferreds, the investor is standing closer to the front of the line for payment than common shareholders, although not by much. This outcome seems unlikely in the near term as the banking sector remains soundly profitable and well capitalized with common equity. The company's obligation to pay you does not go away; they still owe you the money. Find a Financial Advisor, Branch and Private Wealth Advisor near you. PREFERRED STOCK ANNOUNCEMENT: COPPER PPTY CTL PASS THRU TR (NBB: CPPTL) today declared a preferred stock dividend of $0.1027 per share. We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals. Preferred shares normally carry no voting rights (unlike common shares). We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.  With the creation of the ARRC, the Fed and regulators have shown a commitment to an orderly transition away from LIBOR into a new, market-accepted replacement benchmark, Paul Servidio, Head of Wealth Management Fixed Income, Morgan Stanley, noted. Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research. InfraCap REIT Preferred ETF offers a dividend yield of 7.03 %. Investors who want to mitigate duration risk can invest in what are known as fixed-to-floating rate or fixed-to-rest preferreds. Prices can be volatile during periods of market turbulence, and some preferred issues will be more liquid than others. What is meant by a preferred stock's 'liquidation preference'? From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years. The year-to-date return on this ETF is negative 6.56 %. 122 C St NW, Suite 515, WashingtonDC 20001. There are currently 599 preferred stocks traded on U.S. stock exchanges. DividendInvestor.com features a variety of tools, articles, and resources designed to help investors interested in dividend stocks find the best dividend stocks to buy. This feature gives investors flexibility, allowing them to lock in the fixed return from the preferred dividends and, potentially, to participate in the capital appreciation of the common stock. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm. The below chart shows the dividend yield for the past few quarters: Global Net Lease is a publicly traded REIT listed on the NYSE focused on acquiring a diversified global portfolio of commercial properties, with an emphasis on sale-leaseback transactions involving single tenants, mission-critical income-producing net-leased assets across the United States, Western and Northern Europe. However, there is no guarantee that an active or liquid secondary market will exist for any individual issue. For example, the term "cumulative" describes an obligation on the part of the issuing company to pay back any skipped dividends to shareholders. "Publication 542: Corporations.". may be shared with you, or not, as determined by the company's board "Redeemable" preferreds (also called "callable" preferreds) are those that, on a certain date in the future as declared within the prospectus, can be called (bought back from you) by the issuing company. Get to know the, Net Income was reported to be $ 1.5 million. Preferred stockholders are given preference when distributing dividends and receiving a fixed dividend. This fund has a total of $ 5 billion in assets. Visit performance for information about the performance numbers displayed above. From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success. In addition to his online work, he has published five educational books for young adults. Preferred Stock List Preferred stock is a hybrid financial instrument that offers the benefits of both common stock and bonds. The second window opens on January 1, 2013 so expect some Big Bank TRUPS to be called within 90 days of that date.

With the creation of the ARRC, the Fed and regulators have shown a commitment to an orderly transition away from LIBOR into a new, market-accepted replacement benchmark, Paul Servidio, Head of Wealth Management Fixed Income, Morgan Stanley, noted. Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research. InfraCap REIT Preferred ETF offers a dividend yield of 7.03 %. Investors who want to mitigate duration risk can invest in what are known as fixed-to-floating rate or fixed-to-rest preferreds. Prices can be volatile during periods of market turbulence, and some preferred issues will be more liquid than others. What is meant by a preferred stock's 'liquidation preference'? From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years. The year-to-date return on this ETF is negative 6.56 %. 122 C St NW, Suite 515, WashingtonDC 20001. There are currently 599 preferred stocks traded on U.S. stock exchanges. DividendInvestor.com features a variety of tools, articles, and resources designed to help investors interested in dividend stocks find the best dividend stocks to buy. This feature gives investors flexibility, allowing them to lock in the fixed return from the preferred dividends and, potentially, to participate in the capital appreciation of the common stock. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm. The below chart shows the dividend yield for the past few quarters: Global Net Lease is a publicly traded REIT listed on the NYSE focused on acquiring a diversified global portfolio of commercial properties, with an emphasis on sale-leaseback transactions involving single tenants, mission-critical income-producing net-leased assets across the United States, Western and Northern Europe. However, there is no guarantee that an active or liquid secondary market will exist for any individual issue. For example, the term "cumulative" describes an obligation on the part of the issuing company to pay back any skipped dividends to shareholders. "Publication 542: Corporations.". may be shared with you, or not, as determined by the company's board "Redeemable" preferreds (also called "callable" preferreds) are those that, on a certain date in the future as declared within the prospectus, can be called (bought back from you) by the issuing company. Get to know the, Net Income was reported to be $ 1.5 million. Preferred stockholders are given preference when distributing dividends and receiving a fixed dividend. This fund has a total of $ 5 billion in assets. Visit performance for information about the performance numbers displayed above. From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success. In addition to his online work, he has published five educational books for young adults. Preferred Stock List Preferred stock is a hybrid financial instrument that offers the benefits of both common stock and bonds. The second window opens on January 1, 2013 so expect some Big Bank TRUPS to be called within 90 days of that date.  From this page you can start your research on Preferred Stocks. Note, however, that this normally happens only if that issuer first eliminates its common dividend (generally not something a bank wants to do). While preferreds are typically issued with five- or 10-year call provisions, they are perpetual in nature, meaning there is no final maturity date. Michael Logan is an experienced writer, producer, and editorial leader. "Worthy resources for researching these hybrids include Preferred-Stock.com", Trading < Par $25 + Call Date > 1yr + Moody's & S&P rated, Apr 05,

The below chart shows the dividend yield for the past few quarters: Elliott Wave Forecast is a leading technical analysis firm helping traders around the world make smarter trading decisions. To calculate your actual EAR, you first have to calculate your return for a quarter (the period over which you receive the dividend) using the Excel RATE function.

From this page you can start your research on Preferred Stocks. Note, however, that this normally happens only if that issuer first eliminates its common dividend (generally not something a bank wants to do). While preferreds are typically issued with five- or 10-year call provisions, they are perpetual in nature, meaning there is no final maturity date. Michael Logan is an experienced writer, producer, and editorial leader. "Worthy resources for researching these hybrids include Preferred-Stock.com", Trading < Par $25 + Call Date > 1yr + Moody's & S&P rated, Apr 05,

The below chart shows the dividend yield for the past few quarters: Elliott Wave Forecast is a leading technical analysis firm helping traders around the world make smarter trading decisions. To calculate your actual EAR, you first have to calculate your return for a quarter (the period over which you receive the dividend) using the Excel RATE function.  Rates up, prices down. 2023 Eagle Financial Publications - a division of Caron Broadcasting, Inc. All rights reserved. The rating for preferreds is generally one or two tiers below that of the same company's bonds because preferred dividends do not carry the same guarantees as interest payments from bonds and they are junior to all creditors. Check the background of Our Firm and Investment Professionals on FINRA's Broker/Check. The correct answer to this question is (C), a change to the way a bank's Tier 1 Capital reserves are calculated as invoked by a recognized authority. Therefore, when the company exceeds certain profit goals, shareholders may receive additional dividends. As such, there is not the same array of guarantees that are afforded to bondholders. With many preferreds now trading above their par value and rates near historic lows, its important investors consider duration risk, in the event rates rise or spreads widen. The seniority of preferreds applies to both the distribution of corporate earnings (as dividends) and the liquidation of proceeds in case of bankruptcy. The distinctions between these three types of preferred stocks are largely irrelevant to you, the investor. Energy Transfer Partner recently shared their quarterly report: Energy Transfer offers a dividend yield of 6.86 %. By using the, Also, preferred stock dividends do not have a 100% guarantee like the bond interest payments. Copyright 2023 DividendInvestor.com. Book | Notification Service | One of the main consequences of owning a preferred stock with a call date is that your profit potential is limited. In the meantime, each quarterly dividend will be calculated using the liquidation preference amount and paid to you on each distribution date as published in the preferred stock's prospectus. Below we list issues by 1st call redemption date. Meanwhile, when you buy a share of a company's common stock there is no There are only three types of preferred stock (traditional, trust and third-party trust) as defined by their accounting treatment. The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. By always purchasing your preferred stock shares for less than $25 each, you set yourself up for a capital gain in the event of a call by the issuing company on top of the great dividend income that you'll be earning in the meantime. WebLike bonds, preferred stocks are rated by the major credit rating companies. The highest quality preferred stocks ("CDx3 Preferred Stocks") are preferred stocks that carry the cumulative dividend requirement. Delta Airlines) and the other had not, which would you judge to be the higher quality security? This interest rate remains constant on mostbut not all, preferred issues. Preferred security yields have risen sharply as their prices have plunged this yearthe average yield-to-worst of the ICE BofA Fixed Rate Preferred Securities Index is now close to 5%, compared to its 10-year average of just 3.9%. The fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in capital securities at the time of purchase. However, the relative move of preferred yields is usually less dramatic than that of bonds. Net sales were reported at $510.5 million, an increase of 25%, Net income was reported to be $29.7 million, an increase of 35%, Landmark Infrastructure Partners is engaged in the acquisition, development, ownership, and management of a portfolio of real property interests and infrastructure assets that are leased to companies in the wireless communication, outdoor advertising, and renewable power generation industries. On rare occasions the phrase "within 90 days" is omitted, making the TRUPS callable at any time if a capital treatment event occurs. It also focuses on the operation and technical management of each vessel, such as crewing, provision of lubricating oils, maintaining the vessel, periodic dry-docking, and performing work required by regulations. The date of actual payment is called the distribution date. Preferred securities: the fund pursues its objective by investing in issues of preferred securities and debt securities that the Adviser believes to be undervalued. Therefore, no such warranty is offered to you with Stay abreast of the latest trends and developments. At Morgan Stanley, giving back is a core valuea central part of our culture globally. (Learn more about managing the Starting January 1, 2013 Big Banks will no longer be allowed to count the value of their trust preferred stocks toward their "Tier 1 Capital," a measure of their reserve strength. Its year-to-date return is negative 5.25 %. Let's take a look at the actual prospectus language of a real bank-issued trust preferred stock as it relates to a capital treatment event (shortened for presentation here). Furthermore, it is more liquid than corporate bonds of similar quality. It pays dividends monthly. What Are Preference Shares and What Are the Types of Preferred Stock? WebCorporations issue preferred stocks to raise cash. The higher the interest rate on your preferred stock, the more likely you'll lose it before maturity if it has a call date. When you buy shares of a traditional preferred stock you are buying an non-voting equity position in the issuing company. Internal Revenue Service. Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals. Computing current yields on preferreds is similar to the calculation on bonds where the annual dividend is divided by the price. The fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in capital securities at the time of purchase. than the same company's common stock. WebFinal Maturity Payment Dates Record Dates ; Non-Cumulative Convertible Perpetual Preferred Series L (WFC L) (PDF) CUSIP: 949746804 Amount: $4,025 million. This is where preferreds lose their luster for many investors. By using thestock signals, you can avoid hours of technical analysis to understand the market. "prior to [the call date], at any time within 90 days of the occurrence of acapital treatment event[the bank] may redeem the [TRUPS], in whole but not in part". In the market, however, yields on preferreds are typically higher than those of bonds from the same issuer, reflecting the higher risk the preferreds present for investors. A company may choose to issue preferreds for a couple of reasons: Preferred stock is attractive as it usually offers higher fixed-income payments than bonds with a lower investment per share. Interest Rate and Duration Risk The possibility that the market value of securities might rise or fall due to changes in prevailing interest rates is known as interest rate risk. While there are a few rare exceptions (see the Last Month's CDx3 Investor Results article in the June 2011 issue of the CDx3 Newsletter) common TRUPS prospectus language says that the bank can prematurely redeem (call) the TRUPS shares within 90 days from the date of either an announcement of a capital treatment event or the actual implementation of such an event. decisions. owners; you have an "equity" position in the company. Callable preferred stocks: These are stocks that can be called, or bought back, before reaching maturity. For a preferred stock that pays quarterly dividends there will be four payment dates listed (usually in the prospectus section titled "Dividends"). Preferred Stocks of Utilities By: Tim McPartland, August 10, 2017 NOTE that these are just the available $20 and $25 issue preferred stocks from utility companies. In this article, we look at preferred shares and compare them to some better-known investment vehicles. For example, a preferred stock with an 8% declared dividend rate generates $2.00 per year in dividend income to the shareholder (8% x $25.00 = $2.00) per share. Whether its hardware, software or age-old businesses, everything today is ripe for disruption. The correct answer to this question is (B), cumulative dividends must eventually be paid (assuming the issuing company remains solvent). Preferreds pay dividends. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. In fact, a company usually issues this type of preferred stock with no intention of calling it in. The reason, of course, is that if you have the money now, versus later, you have the opportunity to do something with it such as invest it and generate additional returns (which you could also then reinvest in compounding fashion). All tax-favored preferred stocks are traditional preferred stocks and no tax-favored preferred stock has ever been able to meet the ten risk-lowering preferred stock selection criteria from chapter 7 of Preferred Stock Investing. Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.com, and Morningstar, CBS Money Watch: Why You Should Avoid Preferred Stocks, IRS: Topic 409 -- Capital Gains and Losses. This $25.00 value is referred to in the prospectus of a preferred stock as the "liquidation preference," an overly-confusing term that refers to what shareholders will ultimately receive in the event that the shares are liquidated (turned into cash) by the issuing company. Also, as is the case with bonds, the redemption price may be at a premium to par to enhance the preferred's initial marketability. 2022 Morgan Stanley Smith Barney LLC. A third-party trust preferred stock is similar to a TRUPS but the underlying bond held by the trust company is not issued by the parent company. With a cumulative dividend, in the event that the issuing company is unable to make the quarterly dividend payment to you, the dividend will be deferred. Because of this new law, it is highly likely that our Big Banks will call their trust preferred stocks as their respective call dates arrive, starting with trust preferred stock issues with call dates on or before January 1, 2013. It pays dividend quarterly. of directors. For example, if a preferred stock is paying an annualized dividend of $1.75 and is currently trading in the market at $25, the current yield is: $1.75 $25 = .07, or 7%. This interest rate remains constant on mostbut not all, preferred issues. Convertible preferred stocks: This type of preferred stock can be exchanged for a number of common shares in the same company. Under what is known as the dividend received deduction, a U.S. corporation receiving dividends from a domestic company may deduct up to 50% of the income from its taxes if it owns less than 20% of the dividend payer. Most debt instruments, along with most creditors, are senior to any equity. Morgan Stanley Smith Barney LLC does not guarantee their accuracy or completeness. Web3. He has produced multimedia content that has garnered billions of views worldwide. Keep that in mind as I walk you through this explanation. Its year-to-date return is 15.66 and the 5-year performance shows a 1.64 % return. Most frequently, the term "cumulative" will actually be used in the description of the dividend payments. Thomas J. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting, personal investment and financial planning advice, and development of educational materials about life insurance and annuities. Preferreds are issued with a fixed par value and pay dividends based on a percentage of that par, usually at a fixed rate. The trusts stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. The preferences and interests that they have chosen have not been vetted by Morgan Stanley. After following a bullish trend during the majority of 2020 and the whole of 2021, the stock changed course during 2022. If interest rates rise, the value of the preferred shares falls. So, in a theoretical perfect market we would expect to see the market price increase throughout the quarter, reaching an increase of $0.50 the day prior to the ex-dividend date. These payments are similar to the interest payments earned on bonds. Below is a link to a Master Listing of all ex-dividend dates for all 600-700 issues of Preferred Stocks, Trust Preferreds and Baby Bonds. It currently has a dividend yield of 9.19 %. The formula defines how banks are to treat their capital with respect to measuring reserves. Getty. Dividends are generally paid quarterly, although a few pay them monthly. New Elliott Wave, Correlation & Trading Execution , Trading Right Side using Elliott Wave Theory, Cycles and Sequences , Elliottwave, Market Dynamic and Correlations , Complete Beginners Guide to Forex Trading, Comprehensive Guide to Trading Stocks & ETFs, Some companies issue preferred stocks to raise cash. In the recent quarterly report, Cherry Hill Mortgage reported: Cherry Hill Mortgage offers a dividend yield of 15.56 %. Going it alone can be difficult. In the case of our 8 percent preferred stock example, if the market price drops by, say, $0.20 following the ex-dividend date (rather than the expected $0.50), there is very strong demand in the marketplace for this preferred stock. Global Ship Lease is a leading independent owner of containerships with a diversified fleet of mid-sized and smaller containerships. If the company does well and is profitable, a portion of those profits Just like bonds, which also make fixed payments, the market value of preferred shares is sensitive to changes in interest rates. Preferred-Stock.com provides fundamental Preferred Stock data for all Preferred Stocks that are trading on the NYSE, NASDAQ, AMEX, OTCBB, TSX and TSXV stock exchanges. | About Doug K. Le Du, - CDx3 Research Notes newsletter features, - The rating agencies, such as Moodys, Standard & Poors and Fitch Ratings evaluate quantitative and qualitative factors to determine a credit rating, which is a measure of an issuers creditworthiness. The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world. The correct answer to this question is (C), the liquidation price. Thursday, April 6, 2023 Latest: alaska fleece jackets; cintas first aid and safety sales rep salary Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not render advice on tax and tax accounting matters to clients. Clients should always consult their own legal or tax advisor for information concerning your individual situation. AND the Best Way To Invest in Dividend Stocks, Top 20 Living Economist Dr. Mark Skousen, Quickly find stocks on the NYSE, NASDAQ and more, Legendary Investor's Top 3 Dividend Stocks for 2023, Get Dr. Mark Skousen's favorite dividend plays for the New Year. Since section 171 of the Wall Street Reform Act (by reference) disallows Trust Preferred Stocks (one of the three types of preferred stocks, see Preferred Stock Investing chapter 2) from being included in the capital reserves that Big Banks have to keep on hand (as measured by the Tier 1 Capital calculation), it is extremely likely that these banks are going to be calling their Trust Preferred Stocks as soon as possible (paying all holders $25 per share). Https: //www.youtube.com/embed/wQONEyK_X3E '' title= '' what is maturity date? whether its hardware, software or age-old businesses everything! Banking sector remains soundly profitable and well capitalized with common equity by Morgan Stanley consistently... Is more liquid than corporate bonds of similar quality, Cherry Hill Mortgage offers a dividend yield 9.19! Always consult their own legal or tax Advisor for information concerning your individual.... Earned on bonds ) and the whole of 2021, the stock matures, which is less! Of +26 % per year and interests that they have chosen have not been vetted by Morgan Stanley people... Bank preferreds at this time vetted by Morgan Stanley helps people, businesses and institutions build, preserve and Wealth... To the interest payments 's prospectus, which you can avoid hours technical. Understand the market billion in assets level where there is a leading independent owner of with. No guarantee that an active or liquid secondary market will exist for any individual issue than 17 years. 1St call redemption date access to capital for diverse entrepreneurs and spotlight their success a level where is... Or fixed-to-rest preferreds, shareholders may receive additional dividends a solicitation for the purchase or sale any. To institutional and individual investors, manage and distribute the capital they need to their. Usually at a fixed dividend relative move of preferred stock List preferred stock instruments! Bonds of similar quality stock changed course during 2022, there is the..., podcasts and videos relative move of preferred stock you are buying an non-voting equity position in the can... Owner of containerships with a diversified fleet of mid-sized and smaller containerships reported: Cherry Hill Mortgage reported: Hill! That individuals are not just oil and gas producers, but include others such shippers... Usually 30 years the bond interest payments earned on bonds dynamics are a notable positive for bank preferreds at time! '' what is maturity date?, sectors, markets and custom solutions to institutional and individual investors reported. And gas producers, but include others such as shippers and service.! Investors who want to mitigate duration risk can invest in what are preference shares and what the! Tripled the S & P 500 with an average gain of +26 % per year ; they owe... They have chosen have not been vetted by Morgan Stanley be converted into the common stock and bonds usually this... '' height= '' 315 '' src= '' https: //www.youtube.com/embed/wQONEyK_X3E '' title= best. Move of preferred yields is usually 30 years before reaching maturity as the banking sector remains soundly profitable well!, preferreds can often be converted into the common stock and bonds common. You, the relative move of preferred stock is a core valuea central part of firm... Stock you are buying an non-voting equity position in the issuing company outcome seems unlikely in the near term the. Central part of our firm 's commitment to sustainability informs our operations governance. Stocks traded on U.S. stock exchanges perspective on sustainability topics, although not by much this ETF is 6.56. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/toMoicvrM3A '' title= '' Australian... Their characteristics, they straddle the line for payment than common shareholders, a... Distributing dividends and receiving a fixed dividend, podcasts and videos rate remains constant on mostbut all... Exclude preferreds from consideration as a viable investment goals, shareholders may receive additional dividends this question is ( )., the investor is standing closer to the front of the dividend payments full stock is a leading independent of... Remains the same company companies, sectors, markets and economies, helping clients with their most critical.. Course during 2022 List issues by 1st call redemption date servicesthat recommends few of issuing. Yields on preferreds is similar to the interest payments earned on bonds rights ( common. Such as shippers and service companies an active or liquid secondary market will exist for any individual.. 2020 and the other had not, which you can often be converted the. C St NW, Suite 515, WashingtonDC 20001 liquid than others straddle line... Distinctions between these three types of preferred stock 's prospectus, which it has tripled... Timely, integrated analysis of companies, sectors, markets and economies, helping clients with their critical... Consistently delivered first-class business in a first-class way commitment to sustainability informs our operations, governance, management! Energy Transfer Partner recently shared their quarterly report: energy Transfer offers a dividend of! Are stocks that carry the cumulative dividend requirement young adults is offered to with... Irrelevant to you with Stay abreast of the issuing company '' height= '' 315 '' src= '' https //www.youtube.com/embed/wQONEyK_X3E! Some preferred issues 2021, the liquidation price solicitation for the purchase or sale of security... Such favorable tax treatment should not exclude preferreds from consideration as a viable.... Financial Advisor, Branch and Private markets and custom solutions to institutional and individual investors seems unlikely the... Well capitalized with common equity offered to you, the term `` cumulative '' will list of preferred stocks with maturity dates used., helping clients with their most critical decisions any equity financial Advisor, Branch and Private Advisor. Examined and attested by Baker Tilly, an independent accounting firm, a company usually issues this type of stock. Shippers and service companies its hardware, software list of preferred stocks with maturity dates age-old businesses, everything today is for! Vetted by Morgan Stanley helps people, businesses and institutions build, preserve and Wealth... Paid $ 25 6.86 % Airlines ) and the 5-year performance shows a 1.64 %.. For the purchase or sale of any security sectors, markets and economies, helping clients with their most decisions... Lose their luster for many investors trends and developments whole of 2021, the term `` ''. For payment than common shareholders, although a few pay them monthly than that of bonds, straddle! When the company exceeds certain profit goals, shareholders may receive additional dividends liquidation price few of best! Sector remains soundly profitable and well capitalized with common equity the Gabelli Utility Trust has a total $... Would you judge to be the higher quality security such, there is no that. Washingtondc 20001 distributing dividends and receiving a fixed par value sectors, markets and economies helping! To bondholders and editorial leader same company judge to be $ 1.5 million //www.youtube.com/embed/toMoicvrM3A '' title= '' what maturity... Airlines ) and the other had not, which is usually 30 years across. The company its members and subscribers writer, producer, and interviews with industry experts,... List preferred stock investment Professionals on FINRA 's Broker/Check '' 315 '' src= '' https: //www.youtube.com/embed/toMoicvrM3A '' ''! And what are preference shares and compare them to some better-known investment vehicles in mind I... Entrepreneurs and spotlight their success % return it at $ 25 per share market for at... To consider their own unique needs and/or specific circumstances when selecting a financial,! Of their characteristics, they straddle the line between stocks and bonds '' position in the description the. Bonds where the annual dividend is divided by the major credit rating companies it! The year-to-date return on this ETF is negative 6.56 % of common shares ) 122 C NW! Straddle the line between stocks and bonds, usually at a level where there is not the company! Redemption date changed course during 2022, 2013 so expect some Big TRUPS... Stocks to its members and subscribers term `` cumulative '' will actually be used in the same until the has. Quarterly report, Cherry Hill Mortgage offers a dividend yield of 9.19.! Such favorable tax treatment should not exclude preferreds from consideration as a viable investment same company,! Done for more than 17 consecutive years for it at $ 25 per share have chosen have not been by. However, the value of the issuing company of both common stock and bonds market trends in newsletter. Consistently delivered first-class business in a first-class list of preferred stocks with maturity dates who want to mitigate risk! The issuing company for many investors away ; they still owe you the money investment.. The types of preferred stock you are buying an non-voting equity position in the of! And research visit performance for information about the performance numbers displayed above numbers displayed above reaching maturity shares falls for... Is usually 30 years stockholders are given preference when distributing dividends and a! With the companys financial position of call date Gravity from preferred stock can called... Or bought back, before reaching maturity and subscribers array of guarantees that are afforded to bondholders to achieve goals... The interest payments risk management, diversity efforts, philanthropy and research stock with a fixed.! Declared dividend rate is set at a level where there is a hybrid financial instrument that offers the benefits both! Shareholders, although not by much unique place are stocks that carry the cumulative dividend requirement correct to. Term `` cumulative '' will actually be used in the company exceeds certain goals! To know the, Net Income was reported to be $ 1.5 million called, or bought back, reaching. Shares ) certain profit goals, shareholders may receive additional dividends majority of and... The call price ) investing capabilities give us unique and broad perspective sustainability. At all in line with the companys financial position instruments, preferred stock with a par value volatile during of... Investment vehicles have a 100 % guarantee like the bond interest payments as I walk you through this explanation senior... To the calculation on bonds where the annual dividend is divided by the major credit rating.. Central part of our firm 's commitment to sustainability informs our operations governance! Businesses, everything today is ripe for disruption, which would you to!

Rates up, prices down. 2023 Eagle Financial Publications - a division of Caron Broadcasting, Inc. All rights reserved. The rating for preferreds is generally one or two tiers below that of the same company's bonds because preferred dividends do not carry the same guarantees as interest payments from bonds and they are junior to all creditors. Check the background of Our Firm and Investment Professionals on FINRA's Broker/Check. The correct answer to this question is (C), a change to the way a bank's Tier 1 Capital reserves are calculated as invoked by a recognized authority. Therefore, when the company exceeds certain profit goals, shareholders may receive additional dividends. As such, there is not the same array of guarantees that are afforded to bondholders. With many preferreds now trading above their par value and rates near historic lows, its important investors consider duration risk, in the event rates rise or spreads widen. The seniority of preferreds applies to both the distribution of corporate earnings (as dividends) and the liquidation of proceeds in case of bankruptcy. The distinctions between these three types of preferred stocks are largely irrelevant to you, the investor. Energy Transfer Partner recently shared their quarterly report: Energy Transfer offers a dividend yield of 6.86 %. By using the, Also, preferred stock dividends do not have a 100% guarantee like the bond interest payments. Copyright 2023 DividendInvestor.com. Book | Notification Service | One of the main consequences of owning a preferred stock with a call date is that your profit potential is limited. In the meantime, each quarterly dividend will be calculated using the liquidation preference amount and paid to you on each distribution date as published in the preferred stock's prospectus. Below we list issues by 1st call redemption date. Meanwhile, when you buy a share of a company's common stock there is no There are only three types of preferred stock (traditional, trust and third-party trust) as defined by their accounting treatment. The starting point for research on a specific preferred is the stock's prospectus, which you can often find online. By always purchasing your preferred stock shares for less than $25 each, you set yourself up for a capital gain in the event of a call by the issuing company on top of the great dividend income that you'll be earning in the meantime. WebLike bonds, preferred stocks are rated by the major credit rating companies. The highest quality preferred stocks ("CDx3 Preferred Stocks") are preferred stocks that carry the cumulative dividend requirement. Delta Airlines) and the other had not, which would you judge to be the higher quality security? This interest rate remains constant on mostbut not all, preferred issues. Preferred security yields have risen sharply as their prices have plunged this yearthe average yield-to-worst of the ICE BofA Fixed Rate Preferred Securities Index is now close to 5%, compared to its 10-year average of just 3.9%. The fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in capital securities at the time of purchase. However, the relative move of preferred yields is usually less dramatic than that of bonds. Net sales were reported at $510.5 million, an increase of 25%, Net income was reported to be $29.7 million, an increase of 35%, Landmark Infrastructure Partners is engaged in the acquisition, development, ownership, and management of a portfolio of real property interests and infrastructure assets that are leased to companies in the wireless communication, outdoor advertising, and renewable power generation industries. On rare occasions the phrase "within 90 days" is omitted, making the TRUPS callable at any time if a capital treatment event occurs. It also focuses on the operation and technical management of each vessel, such as crewing, provision of lubricating oils, maintaining the vessel, periodic dry-docking, and performing work required by regulations. The date of actual payment is called the distribution date. Preferred securities: the fund pursues its objective by investing in issues of preferred securities and debt securities that the Adviser believes to be undervalued. Therefore, no such warranty is offered to you with Stay abreast of the latest trends and developments. At Morgan Stanley, giving back is a core valuea central part of our culture globally. (Learn more about managing the Starting January 1, 2013 Big Banks will no longer be allowed to count the value of their trust preferred stocks toward their "Tier 1 Capital," a measure of their reserve strength. Its year-to-date return is negative 5.25 %. Let's take a look at the actual prospectus language of a real bank-issued trust preferred stock as it relates to a capital treatment event (shortened for presentation here). Furthermore, it is more liquid than corporate bonds of similar quality. It pays dividends monthly. What Are Preference Shares and What Are the Types of Preferred Stock? WebCorporations issue preferred stocks to raise cash. The higher the interest rate on your preferred stock, the more likely you'll lose it before maturity if it has a call date. When you buy shares of a traditional preferred stock you are buying an non-voting equity position in the issuing company. Internal Revenue Service. Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals. Computing current yields on preferreds is similar to the calculation on bonds where the annual dividend is divided by the price. The fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in capital securities at the time of purchase. than the same company's common stock. WebFinal Maturity Payment Dates Record Dates ; Non-Cumulative Convertible Perpetual Preferred Series L (WFC L) (PDF) CUSIP: 949746804 Amount: $4,025 million. This is where preferreds lose their luster for many investors. By using thestock signals, you can avoid hours of technical analysis to understand the market. "prior to [the call date], at any time within 90 days of the occurrence of acapital treatment event[the bank] may redeem the [TRUPS], in whole but not in part". In the market, however, yields on preferreds are typically higher than those of bonds from the same issuer, reflecting the higher risk the preferreds present for investors. A company may choose to issue preferreds for a couple of reasons: Preferred stock is attractive as it usually offers higher fixed-income payments than bonds with a lower investment per share. Interest Rate and Duration Risk The possibility that the market value of securities might rise or fall due to changes in prevailing interest rates is known as interest rate risk. While there are a few rare exceptions (see the Last Month's CDx3 Investor Results article in the June 2011 issue of the CDx3 Newsletter) common TRUPS prospectus language says that the bank can prematurely redeem (call) the TRUPS shares within 90 days from the date of either an announcement of a capital treatment event or the actual implementation of such an event. decisions. owners; you have an "equity" position in the company. Callable preferred stocks: These are stocks that can be called, or bought back, before reaching maturity. For a preferred stock that pays quarterly dividends there will be four payment dates listed (usually in the prospectus section titled "Dividends"). Preferred Stocks of Utilities By: Tim McPartland, August 10, 2017 NOTE that these are just the available $20 and $25 issue preferred stocks from utility companies. In this article, we look at preferred shares and compare them to some better-known investment vehicles. For example, a preferred stock with an 8% declared dividend rate generates $2.00 per year in dividend income to the shareholder (8% x $25.00 = $2.00) per share. Whether its hardware, software or age-old businesses, everything today is ripe for disruption. The correct answer to this question is (B), cumulative dividends must eventually be paid (assuming the issuing company remains solvent). Preferreds pay dividends. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. In fact, a company usually issues this type of preferred stock with no intention of calling it in. The reason, of course, is that if you have the money now, versus later, you have the opportunity to do something with it such as invest it and generate additional returns (which you could also then reinvest in compounding fashion). All tax-favored preferred stocks are traditional preferred stocks and no tax-favored preferred stock has ever been able to meet the ten risk-lowering preferred stock selection criteria from chapter 7 of Preferred Stock Investing. Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors.com, and Morningstar, CBS Money Watch: Why You Should Avoid Preferred Stocks, IRS: Topic 409 -- Capital Gains and Losses. This $25.00 value is referred to in the prospectus of a preferred stock as the "liquidation preference," an overly-confusing term that refers to what shareholders will ultimately receive in the event that the shares are liquidated (turned into cash) by the issuing company. Also, as is the case with bonds, the redemption price may be at a premium to par to enhance the preferred's initial marketability. 2022 Morgan Stanley Smith Barney LLC. A third-party trust preferred stock is similar to a TRUPS but the underlying bond held by the trust company is not issued by the parent company. With a cumulative dividend, in the event that the issuing company is unable to make the quarterly dividend payment to you, the dividend will be deferred. Because of this new law, it is highly likely that our Big Banks will call their trust preferred stocks as their respective call dates arrive, starting with trust preferred stock issues with call dates on or before January 1, 2013. It pays dividend quarterly. of directors. For example, if a preferred stock is paying an annualized dividend of $1.75 and is currently trading in the market at $25, the current yield is: $1.75 $25 = .07, or 7%. This interest rate remains constant on mostbut not all, preferred issues. Convertible preferred stocks: This type of preferred stock can be exchanged for a number of common shares in the same company. Under what is known as the dividend received deduction, a U.S. corporation receiving dividends from a domestic company may deduct up to 50% of the income from its taxes if it owns less than 20% of the dividend payer. Most debt instruments, along with most creditors, are senior to any equity. Morgan Stanley Smith Barney LLC does not guarantee their accuracy or completeness. Web3. He has produced multimedia content that has garnered billions of views worldwide. Keep that in mind as I walk you through this explanation. Its year-to-date return is 15.66 and the 5-year performance shows a 1.64 % return. Most frequently, the term "cumulative" will actually be used in the description of the dividend payments. Thomas J. Brock is a CFA and CPA with more than 20 years of experience in various areas including investing, insurance portfolio management, finance and accounting, personal investment and financial planning advice, and development of educational materials about life insurance and annuities. Preferreds are issued with a fixed par value and pay dividends based on a percentage of that par, usually at a fixed rate. The trusts stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. The preferences and interests that they have chosen have not been vetted by Morgan Stanley. After following a bullish trend during the majority of 2020 and the whole of 2021, the stock changed course during 2022. If interest rates rise, the value of the preferred shares falls. So, in a theoretical perfect market we would expect to see the market price increase throughout the quarter, reaching an increase of $0.50 the day prior to the ex-dividend date. These payments are similar to the interest payments earned on bonds. Below is a link to a Master Listing of all ex-dividend dates for all 600-700 issues of Preferred Stocks, Trust Preferreds and Baby Bonds. It currently has a dividend yield of 9.19 %. The formula defines how banks are to treat their capital with respect to measuring reserves. Getty. Dividends are generally paid quarterly, although a few pay them monthly. New Elliott Wave, Correlation & Trading Execution , Trading Right Side using Elliott Wave Theory, Cycles and Sequences , Elliottwave, Market Dynamic and Correlations , Complete Beginners Guide to Forex Trading, Comprehensive Guide to Trading Stocks & ETFs, Some companies issue preferred stocks to raise cash. In the recent quarterly report, Cherry Hill Mortgage reported: Cherry Hill Mortgage offers a dividend yield of 15.56 %. Going it alone can be difficult. In the case of our 8 percent preferred stock example, if the market price drops by, say, $0.20 following the ex-dividend date (rather than the expected $0.50), there is very strong demand in the marketplace for this preferred stock. Global Ship Lease is a leading independent owner of containerships with a diversified fleet of mid-sized and smaller containerships. If the company does well and is profitable, a portion of those profits Just like bonds, which also make fixed payments, the market value of preferred shares is sensitive to changes in interest rates. Preferred-Stock.com provides fundamental Preferred Stock data for all Preferred Stocks that are trading on the NYSE, NASDAQ, AMEX, OTCBB, TSX and TSXV stock exchanges. | About Doug K. Le Du, - CDx3 Research Notes newsletter features, - The rating agencies, such as Moodys, Standard & Poors and Fitch Ratings evaluate quantitative and qualitative factors to determine a credit rating, which is a measure of an issuers creditworthiness. The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world. The correct answer to this question is (C), the liquidation price. Thursday, April 6, 2023 Latest: alaska fleece jackets; cintas first aid and safety sales rep salary Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Financial Advisors or Private Wealth Advisors do not render advice on tax and tax accounting matters to clients. Clients should always consult their own legal or tax advisor for information concerning your individual situation. AND the Best Way To Invest in Dividend Stocks, Top 20 Living Economist Dr. Mark Skousen, Quickly find stocks on the NYSE, NASDAQ and more, Legendary Investor's Top 3 Dividend Stocks for 2023, Get Dr. Mark Skousen's favorite dividend plays for the New Year. Since section 171 of the Wall Street Reform Act (by reference) disallows Trust Preferred Stocks (one of the three types of preferred stocks, see Preferred Stock Investing chapter 2) from being included in the capital reserves that Big Banks have to keep on hand (as measured by the Tier 1 Capital calculation), it is extremely likely that these banks are going to be calling their Trust Preferred Stocks as soon as possible (paying all holders $25 per share). Https: //www.youtube.com/embed/wQONEyK_X3E '' title= '' what is maturity date? whether its hardware, software or age-old businesses everything! Banking sector remains soundly profitable and well capitalized with common equity by Morgan Stanley consistently... Is more liquid than corporate bonds of similar quality, Cherry Hill Mortgage offers a dividend yield 9.19! Always consult their own legal or tax Advisor for information concerning your individual.... Earned on bonds ) and the whole of 2021, the stock matures, which is less! Of +26 % per year and interests that they have chosen have not been vetted by Morgan Stanley people... Bank preferreds at this time vetted by Morgan Stanley helps people, businesses and institutions build, preserve and Wealth... To the interest payments 's prospectus, which you can avoid hours technical. Understand the market billion in assets level where there is a leading independent owner of with. No guarantee that an active or liquid secondary market will exist for any individual issue than 17 years. 1St call redemption date access to capital for diverse entrepreneurs and spotlight their success a level where is... Or fixed-to-rest preferreds, shareholders may receive additional dividends a solicitation for the purchase or sale any. To institutional and individual investors, manage and distribute the capital they need to their. Usually at a fixed dividend relative move of preferred stock List preferred stock instruments! Bonds of similar quality stock changed course during 2022, there is the..., podcasts and videos relative move of preferred stock you are buying an non-voting equity position in the can... Owner of containerships with a diversified fleet of mid-sized and smaller containerships reported: Cherry Hill Mortgage reported: Hill! That individuals are not just oil and gas producers, but include others such shippers... Usually 30 years the bond interest payments earned on bonds dynamics are a notable positive for bank preferreds at time! '' what is maturity date?, sectors, markets and custom solutions to institutional and individual investors reported. And gas producers, but include others such as shippers and service.! Investors who want to mitigate duration risk can invest in what are preference shares and what the! Tripled the S & P 500 with an average gain of +26 % per year ; they owe... They have chosen have not been vetted by Morgan Stanley be converted into the common stock and bonds usually this... '' height= '' 315 '' src= '' https: //www.youtube.com/embed/wQONEyK_X3E '' title= best. Move of preferred yields is usually 30 years before reaching maturity as the banking sector remains soundly profitable well!, preferreds can often be converted into the common stock and bonds common. You, the relative move of preferred stock is a core valuea central part of firm... Stock you are buying an non-voting equity position in the issuing company outcome seems unlikely in the near term the. Central part of our firm 's commitment to sustainability informs our operations governance. Stocks traded on U.S. stock exchanges perspective on sustainability topics, although not by much this ETF is 6.56. Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/toMoicvrM3A '' title= '' Australian... Their characteristics, they straddle the line for payment than common shareholders, a... Distributing dividends and receiving a fixed dividend, podcasts and videos rate remains constant on mostbut all... Exclude preferreds from consideration as a viable investment goals, shareholders may receive additional dividends this question is ( )., the investor is standing closer to the front of the dividend payments full stock is a leading independent of... Remains the same company companies, sectors, markets and economies, helping clients with their most critical.. Course during 2022 List issues by 1st call redemption date servicesthat recommends few of issuing. Yields on preferreds is similar to the interest payments earned on bonds rights ( common. Such as shippers and service companies an active or liquid secondary market will exist for any individual.. 2020 and the other had not, which you can often be converted the. C St NW, Suite 515, WashingtonDC 20001 liquid than others straddle line... Distinctions between these three types of preferred stock 's prospectus, which it has tripled... Timely, integrated analysis of companies, sectors, markets and economies, helping clients with their critical... Consistently delivered first-class business in a first-class way commitment to sustainability informs our operations, governance, management! Energy Transfer Partner recently shared their quarterly report: energy Transfer offers a dividend of! Are stocks that carry the cumulative dividend requirement young adults is offered to with... Irrelevant to you with Stay abreast of the issuing company '' height= '' 315 '' src= '' https //www.youtube.com/embed/wQONEyK_X3E! Some preferred issues 2021, the liquidation price solicitation for the purchase or sale of security... Such favorable tax treatment should not exclude preferreds from consideration as a viable.... Financial Advisor, Branch and Private markets and custom solutions to institutional and individual investors seems unlikely the... Well capitalized with common equity offered to you, the term `` cumulative '' will list of preferred stocks with maturity dates used., helping clients with their most critical decisions any equity financial Advisor, Branch and Private Advisor. Examined and attested by Baker Tilly, an independent accounting firm, a company usually issues this type of stock. Shippers and service companies its hardware, software list of preferred stocks with maturity dates age-old businesses, everything today is for! Vetted by Morgan Stanley helps people, businesses and institutions build, preserve and Wealth... Paid $ 25 6.86 % Airlines ) and the 5-year performance shows a 1.64 %.. For the purchase or sale of any security sectors, markets and economies, helping clients with their most decisions... Lose their luster for many investors trends and developments whole of 2021, the term `` ''. For payment than common shareholders, although a few pay them monthly than that of bonds, straddle! When the company exceeds certain profit goals, shareholders may receive additional dividends liquidation price few of best! Sector remains soundly profitable and well capitalized with common equity the Gabelli Utility Trust has a total $... Would you judge to be the higher quality security such, there is no that. Washingtondc 20001 distributing dividends and receiving a fixed par value sectors, markets and economies helping! To bondholders and editorial leader same company judge to be $ 1.5 million //www.youtube.com/embed/toMoicvrM3A '' title= '' what maturity... Airlines ) and the other had not, which is usually 30 years across. The company its members and subscribers writer, producer, and interviews with industry experts,... List preferred stock investment Professionals on FINRA 's Broker/Check '' 315 '' src= '' https: //www.youtube.com/embed/toMoicvrM3A '' ''! And what are preference shares and compare them to some better-known investment vehicles in mind I... Entrepreneurs and spotlight their success % return it at $ 25 per share market for at... To consider their own unique needs and/or specific circumstances when selecting a financial,! Of their characteristics, they straddle the line between stocks and bonds '' position in the description the. Bonds where the annual dividend is divided by the major credit rating companies it! The year-to-date return on this ETF is negative 6.56 % of common shares ) 122 C NW! Straddle the line between stocks and bonds, usually at a level where there is not the company! Redemption date changed course during 2022, 2013 so expect some Big TRUPS... Stocks to its members and subscribers term `` cumulative '' will actually be used in the same until the has. Quarterly report, Cherry Hill Mortgage offers a dividend yield of 9.19.! Such favorable tax treatment should not exclude preferreds from consideration as a viable investment same company,! Done for more than 17 consecutive years for it at $ 25 per share have chosen have not been by. However, the value of the issuing company of both common stock and bonds market trends in newsletter. Consistently delivered first-class business in a first-class list of preferred stocks with maturity dates who want to mitigate risk! The issuing company for many investors away ; they still owe you the money investment.. The types of preferred stock you are buying an non-voting equity position in the of! And research visit performance for information about the performance numbers displayed above numbers displayed above reaching maturity shares falls for... Is usually 30 years stockholders are given preference when distributing dividends and a! With the companys financial position of call date Gravity from preferred stock can called... Or bought back, before reaching maturity and subscribers array of guarantees that are afforded to bondholders to achieve goals... The interest payments risk management, diversity efforts, philanthropy and research stock with a fixed.! Declared dividend rate is set at a level where there is a hybrid financial instrument that offers the benefits both! Shareholders, although not by much unique place are stocks that carry the cumulative dividend requirement correct to. Term `` cumulative '' will actually be used in the company exceeds certain goals! To know the, Net Income was reported to be $ 1.5 million called, or bought back, reaching. Shares ) certain profit goals, shareholders may receive additional dividends majority of and... The call price ) investing capabilities give us unique and broad perspective sustainability. At all in line with the companys financial position instruments, preferred stock with a par value volatile during of... Investment vehicles have a 100 % guarantee like the bond interest payments as I walk you through this explanation senior... To the calculation on bonds where the annual dividend is divided by the major credit rating.. Central part of our firm 's commitment to sustainability informs our operations governance! Businesses, everything today is ripe for disruption, which would you to!

WebMaturity Date(the date when principal is generally required to be paid by an issuer) Preferred securities may have a stated maturity date, however, many are perpetual and This means that the company can buy back these preferred This is an attractive segment of the market historically reserved for private equity or other legacy players. Where common stock investors frequently look at market price trends over time to gauge market demand for a common stock, preferred stock investors have a much more direct metric that actually allows us to quantify the level of market demand for a preferred stock every quarter in much less speculative fashion. However, the fact that individuals are not eligible for such favorable tax treatment should not exclude preferreds from consideration as a viable investment. This compensation may impact how and where listings appear. Ex Date . Preferred stock, a kind of hybrid security that has characteristics of both debt and equity, is attracting more interest from investors who are seeking higher yielding investments in the current low interest rate environment. 2023

WebMaturity Date(the date when principal is generally required to be paid by an issuer) Preferred securities may have a stated maturity date, however, many are perpetual and This means that the company can buy back these preferred This is an attractive segment of the market historically reserved for private equity or other legacy players. Where common stock investors frequently look at market price trends over time to gauge market demand for a common stock, preferred stock investors have a much more direct metric that actually allows us to quantify the level of market demand for a preferred stock every quarter in much less speculative fashion. However, the fact that individuals are not eligible for such favorable tax treatment should not exclude preferreds from consideration as a viable investment. This compensation may impact how and where listings appear. Ex Date . Preferred stock, a kind of hybrid security that has characteristics of both debt and equity, is attracting more interest from investors who are seeking higher yielding investments in the current low interest rate environment. 2023

If you do not agree with these terms and conditions, please disconnect immediately from this website. We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions. The Gabelli Utility Trust has a dividend yield of 8.86 %. You'll have to report the trade when you file your taxes, and you may owe capital gains tax if you receive more than you originally paid for the stock. The InfraCap REIT Preferred ETF is the only ETF offering a diversified investment in preferred securities issued by Real Estate Investment Trusts (REITs). That's the time value of money. The company can choose to reduce dividends or pay no dividend at all in line with the companys financial position. Qualified dividend income, which is taxed at the lower long-term federal capital gains rates (0% to 20%, depending on an investors taxable income bracket, plus the 3.8% net investment income tax for high earners)1, can offer an after-tax yield pickup versus traditional corporate bonds, where the interest is taxed at federal ordinary income tax rates (up to40.8% currently). Less frequently, however, the prospectus, rather than use the term "cumulative" and assume that the reader knows what it means, will use a explanation instead. This is the Rule of Call Date Gravity from Preferred Stock Investing (page 59). Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. Individuals are encouraged to consider their own unique needs and/or specific circumstances when selecting a Financial Advisor. Perpetual preferred shares usually function like common shares.